On November 6, 2025, Korea Tobacco & Food Co., Ltd. (KT&G) released its financial results for the third quarter of 2025. The data showed that the company's core financial indicators improved across the board, with operating profit reaching a five-year high. The new tobacco products (NGP) business was particularly strong, with overseas revenue doubling. At the same time, the company launched a global expansion plan for nicotine bags, injecting strong momentum into future growth.

Key financial metrics: Multiple data points set records, demonstrating strong growth momentum.

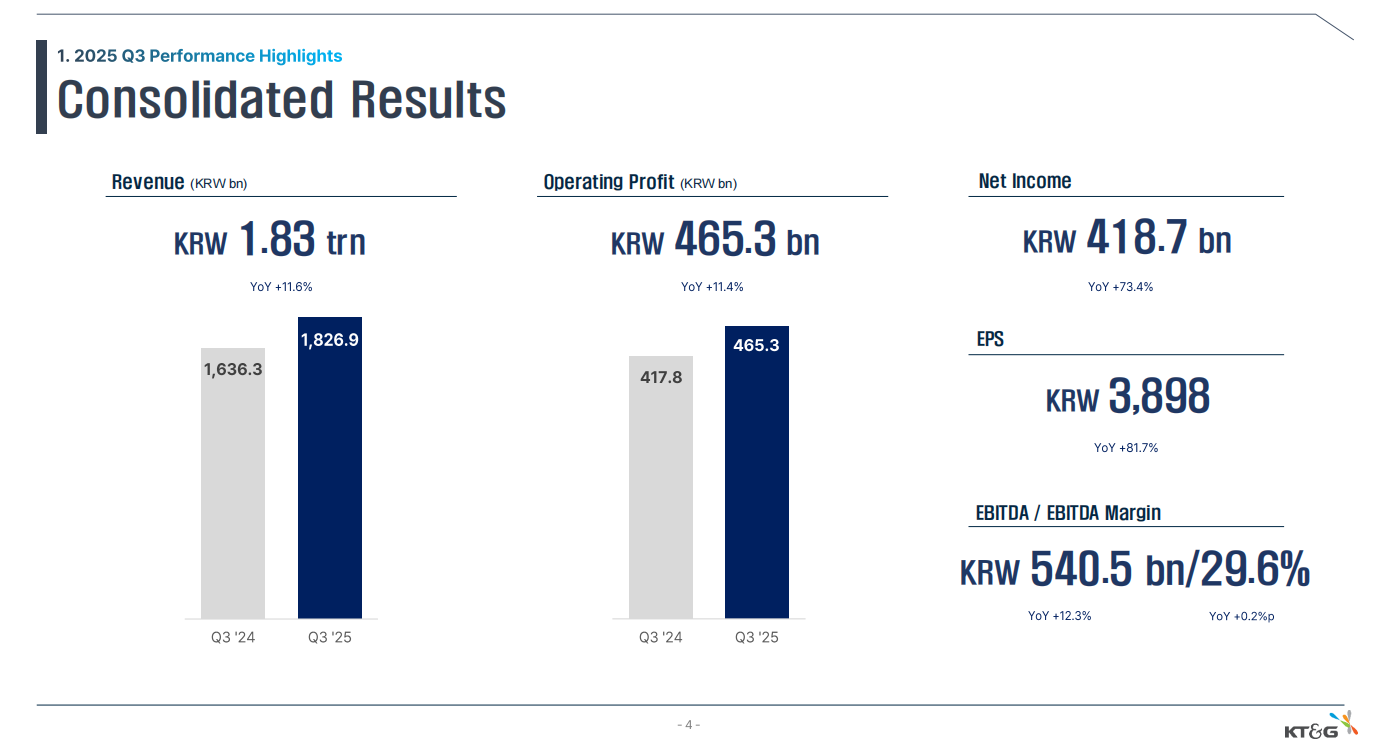

KT&G's overall performance this quarter exceeded market expectations, with significant increases in revenue, profit, and earnings per share.

-

Revenue reached 1.83 trillion won (approximately US$1.307 billion), an increase of 11.6% year-on-year; -

Operating profit was 465.3 billion won (approximately US$332 million), an increase of 11.4% year-on-year; -

Net profit surged 73.4% to 418.7 billion won (approximately US$299 million); -

Earnings per share (EPS) reached 3,898 won (approximately US$2.78), an increase of 81.7% year-on-year; -

Earnings before interest, taxes, depreciation and amortization (EBITDA) reached 540.5 billion won, up 12.3% year-on-year, with the profit margin remaining stable at 29.6%.

Business Breakdown: Tobacco Business Becomes Core Engine, NGP Sees Explosive Growth Overseas

1. Tobacco Business: Driven by a dual engine of international cigarettes and new tobacco products.

As the core business, the tobacco segment saw revenue increase by 17.6% to 1.232 trillion won this quarter, and operating profit increase by 11% to 371.8 billion won, becoming the main pillar of the group's growth.

-

Total sales volume increased by 9.6% year-on-year to 33.15 billion units, of which cigarette sales volume was 29.11 billion units (+9.2%) and new tobacco (NGP) sales volume was 4.04 billion units, maintaining steady growth. -

The international cigarette business performed exceptionally well, with revenue increasing by 30.6% year-on-year, setting a new quarterly record for both sales and revenue. The international market accounted for 62.3% of total sales. -

The South Korean domestic market maintained steady growth, with cigarette sales increasing by 3.5% to 10.69 billion cigarettes and market share rising by 1.5 percentage points to 68.9%, continuing to lead the domestic market.

2. Novel Tobacco Products (NGP): Overseas revenue doubled, domestic revenue remained leading.

The NGP business was the biggest highlight this quarter, mainly due to the launch of the upgraded lil Solid device in Russia and the concentrated delivery of backlogged orders from the first half of the year , driving a 13.3% year-on-year increase in cartridge sales.

-

Total revenue reached 279.1 billion won (approximately US$199 million), a significant increase from 193.2 billion won in the same period of the previous year; -

NGP's overseas performance was outstanding, with overseas revenue reaching 110.8 billion won (approximately US$0.79 billion), more than doubling year-on-year. -

With steady growth in the domestic market, NGP's revenue reached 168.3 billion won (approximately US$120 million), a year-on-year increase of 2%.

Strategic Layout: Acquisitions + Expansion, Increasing Investment in the Global New Tobacco Market

The financial report also disclosed a major strategic move, indicating that KT&G is accelerating its global expansion into new tobacco products:

-

A strategic partnership was formed with Altria to jointly acquire ASF, a Nordic nicotine bag manufacturer, laying the foundation for entering the nicotine bag market. -

The company has launched a global expansion plan , which aims to expand its nicotine bag business from the existing five Nordic markets to multiple regions including Europe, the Middle East, Africa, Asia, and North America starting in 2026, further increasing its global market share.

The strong performance of KT&G's international cigarette business and the rapid expansion of its NGP business are the core driving forces. Despite challenges such as declining domestic demand for cigarettes in South Korea and intensified competition in the new tobacco market, the company is expected to continue to improve its valuation through overseas market expansion, product structure optimization, and strategic mergers and acquisitions.

电子雾化与HNB产品都是新型电子产品,结构虽小,却融合应用多种材料、表面处理、芯片电子等技术工艺,而且雾化技术一直在不断更迭,供应链在逐步完善,为了促进供应链企业间有一个良好的对接交流,艾邦搭建产业微信群交流平台,欢迎加入;Vape e-cigarettes (VAPE) and Heat-Not-Burn e-cigarettes (HNB) are both emerging electronic products. Despite their compact size, they integrate various materials, surface treatment technologies, chip electronics, and other advanced technical processes. Moreover, atomization technology is constantly evolving and the supply chain is being progressively perfected. To facilitate good communication and networking among supply chain enterprises, Aibang has established an industry WeChat group communication platform and warmly welcomes interested enterprises to join.