Note: This article is for industry information reference only and does not constitute any product recommendation, advertising or investment advice

Compared with traditional cigarettes, new tobacco products with harm reduction properties are the future trend . They release nicotine in a non- combustion way . Their essential characteristics are that they do not require combustion, are basically tar-free, and reduce the release of harmful substances.

Multinational tobacco companies represented by Philip Morris International, British American Tobacco, Imperial Tobacco, and Japan Tobacco International have clearly shifted their development focus to new harm-reducing products by increasing R&D investment and accelerating product layout and industrial upgrading.

1.PMI

According to the 2024 Philip Morris International (PMI) annual report, the market performance of its smoke-free product brands IQOS, VEEV and ZYN is as follows:

a. IQOS

- User growth: By the end of 2024, the number of IQOS users worldwide will reach 32.2 million, a net increase of 3.4 million from 2023, and 72% of users will completely switch to IQOS and stop smoking.

- Market share: In Japan, IQOS dominates the heat-not-burn (HNB) market, driving Japan's smoke-free products to account for 47% of total industry sales and exceeding 50% share in the HNB category in 5 prefectures and 10 major cities.

- Market coverage: IQOS launched authorized low-priced products (such as Fiit and Miix) in more than 30 markets, driving shipment growth.

b、VEEV

- European market position: VEEV ranks among the top three e-cigarette brands in 13 European markets, and ranks first in five countries including Italy, Romania and the Czech Republic.

- Strategic positioning: As part of PMI's multi-category strategy, VEEV is mainly aimed at adult multi-product users of IQOS and will be gradually promoted in the global market.

c、ZYN

- Shipment growth: The shipment volume of oral smoke-free products (including nicotine chewing gum) will reach 31.74 billion bags in 2024, an increase of nearly 25% year-on-year, of which nicotine chewing gum will increase by 53%.

- FDA Authorization: ZYN became the first nicotine chewable product authorized by the FDA in the United States. The reasons for approval include significantly lower harmful ingredients than traditional tobacco and low youth usage rate.

- Global Expansion: Nicotine chewables will cover 37 markets from 2023, becoming an important growth engine for PMI in the US market.

Overall performance

- Smoke-free business revenue: In 2024, net revenue from smoke-free products will account for 39% of total revenue, and smoke-free revenue in 23 markets will exceed 50% (including 6 markets exceeding 75%).

- Financial Contribution: IQOS and ZYN drove PMI's full-year adjusted net income growth of 9.8% and adjusted operating profit growth of 14.9%.

2. BAT

According to the 2024 BAT annual report, the market performance of its smoke-free product brands IQOS, VEEV and ZYN is as follows:

a、Vuse

- Market performance: Vuse is the leading brand in the global vapor category, maintaining the first place in value share among the tracking channels (40.0%, down 1.2 percentage points year-on-year).

- US market: Vuse had a 50.2% share of closed-system e-cigarettes (down 2.0 percentage points), but revenue fell 3.5% (down 0.8% at constant exchange rates) due to the proliferation of illegal disposable e-cigarettes.

- Quebec, Canada: Sales fell 32% due to flavor bans and poor enforcement.

- Number of consumers worldwide: 11.9 million, up 100,000 from 2023.

- Product Innovation: Vuse Alto is FDA-authorized, and its mint flavor accounts for 73% of Vuse consumer products.

- Revenue change: Vapour's total revenue falls 5.1% to £1.721 billion in 2024 (£1.812 billion in 2023).

b. Believe

- Market performance: Revenue fell 7.6% due to the sale of the Russian and Belarusian businesses (completed in 2023).

- Market share: In major markets (such as Japan and South Korea), the share fell 40 basis points year-on-year to 16.7% (down 110 basis points in 2023).

- New products: Launch of HyperPro and veo (non-tobacco heating platform), covering 29 markets, and technological improvements (such as HeatBoost and EasyView screen) have improved competitiveness.

- Sales: Heating product sales were 21 billion units, down 12% year-on-year (24 billion units in 2023).

c、Veil

- Market performance: Fastest growing category, with revenue growth of 54.2% and 7.4 million consumers in 2024 (an increase of 3.6 million year-on-year).

- US market: Sales growth was driven by brand renewal and the launch of Grizzly Modern Oral.

- Global layout: sales in 44 markets, with revenue share continuing to increase.

- Sales volume: Modern oral product sales volume was 8.3 billion bags, up 55% year-on-year (5.4 billion bags in 2023).

d. Imperial Brands

According to information from Imperial Tobacco's 2024 annual report, the following brands are expected to perform as follows:

a.Pulse

- In the Polish market , Pulze devices are popular with consumers due to their small size, portability and flavor selection (Julia mentioned that she uses it while reading).

- In Central and Eastern European markets (such as the Czech Republic and Poland), Pulze 2.0 devices are promoted in combination with iSenzia tea-based heating sticks, expanding the product portfolio.

b.Blu

- Performance: Launched 1,000-puff blubar disposable devices and rechargeable blubar kits in the European market, with outstanding performance in the UK, France and Spain. In the Spanish market, blu brand became the joint leader in the e-cigarette retail value sector.

- In the German market, blubar has continued to gain market share since its launch in 2023.

- The U.S. market drove NGP revenue growth through the blu product line, but specific market share was not explicitly mentioned.

c.Screw

Performance: New flavors were introduced in the Norwegian market, but the report did not provide specific growth figures or market share information, only mentioning product line extensions.

d.Zone

Performance: The brand is being promoted primarily in the U.S. market, with 14 flavors launching in 12 metropolitan areas in February 2024. Early consumer repurchase rates and retail channel feedback have been positive.

By leveraging existing sales team resources, store coverage has gradually expanded, becoming the main driving force for NGP's revenue growth in the United States.

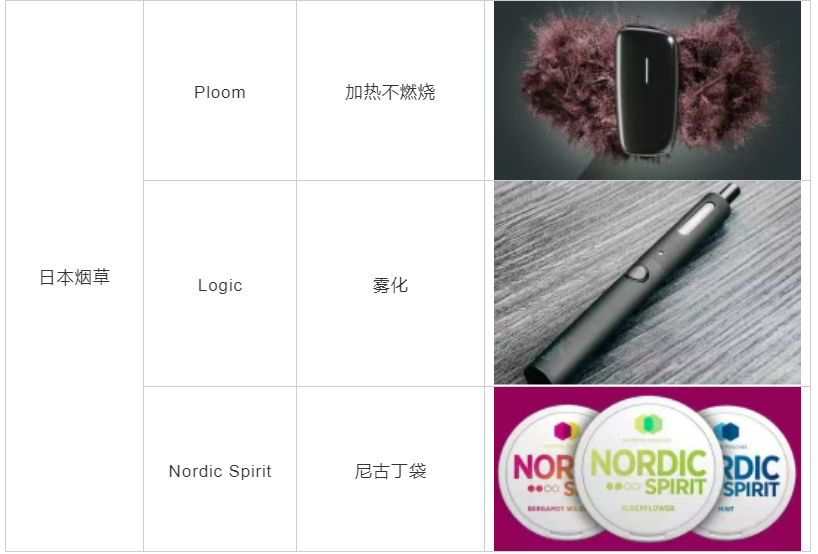

4. JTI

According to the financial report, the market performance of JT Group's brands in 2024 is as follows:

a.Plum

- Market Expansion: By the end of 2024, Ploom's HTS offerings have expanded into 24 markets and have grown its HTS segment share in each market.

- Japanese market (the world's largest HTS market): In the fourth quarter of 2024, Ploom's HTS market share reached 12.6% (an increase of 1.6 percentage points from the previous year).

- HTS sales for the full year increased by 33% year-on-year, pushing Japan's overall RRP (reduced risk product) market share to 13.9%.

- International Markets: HTS sales in markets outside of Japan nearly tripled, but specific market share was not disclosed.

- Financial Contribution: RRP-related revenue increased by 21.1% year-on-year, mainly due to the sales growth of Ploom.

- The company plans to increase investment in the HTS category in its 2025-2027 business plan and expects RRP to make a positive contribution to earnings in the next three years.

b.Nordic Spirit

- UK market performance: RRP sales growth in the UK was driven by Ploom and Nordic Spirit, and specific sales data was not disclosed. Although the overall sales volume of the UK combustible tobacco industry shrank significantly due to the increase in excise duty (total sales volume fell by 17.4%), RRP (including Nordic Spirit) increased its market share.

- Market share: Nordic Spirit’s market share is not disclosed separately, but the UK HTS segment market share (including Ploom and Nordic Spirit) grows to 4.6% in 2024 (up 2.1 percentage points from the previous year).

c.Logic

The financial report does not mention the market performance or financial data of the Logic brand in 2024. Based on previous information , the FDA approved Logic's pre-filled tobacco-flavored devices in 2022, including Logic Pro Capsule Tank System, Logic Vapeleaf Cartridge and other tobacco-flavored products . However, due to the single flavor and regulatory pressure, the Logic brand is still on the defensive in the market .

Last words

It can be seen that in 2024, the world's four largest tobacco giants (PMI, BAT, Imperial Brands, and JTI) will continue to increase their investment in the new tobacco market, presenting a differentiated competitive landscape. Overall, heat-not-burn and nicotine pouch products have grown strongly, while the growth rate of atomized e-cigarettes has slowed down due to regulatory influences.

电子雾化与HNB产品都是新型电子产品,结构虽小,却融合应用多种材料、表面处理、芯片电子等技术工艺,而且雾化技术一直在不断更迭,供应链在逐步完善,为了促进供应链企业间有一个良好的对接交流,艾邦搭建产业微信群交流平台,欢迎加入;Vape e-cigarettes (VAPE) and Heat-Not-Burn e-cigarettes (HNB) are both emerging electronic products. Despite their compact size, they integrate various materials, surface treatment technologies, chip electronics, and other advanced technical processes. Moreover, atomization technology is constantly evolving and the supply chain is being progressively perfected. To facilitate good communication and networking among supply chain enterprises, Aibang has established an industry WeChat group communication platform and warmly welcomes interested enterprises to join.