1. Both revenue and profit increased, mainly due to tobacco business

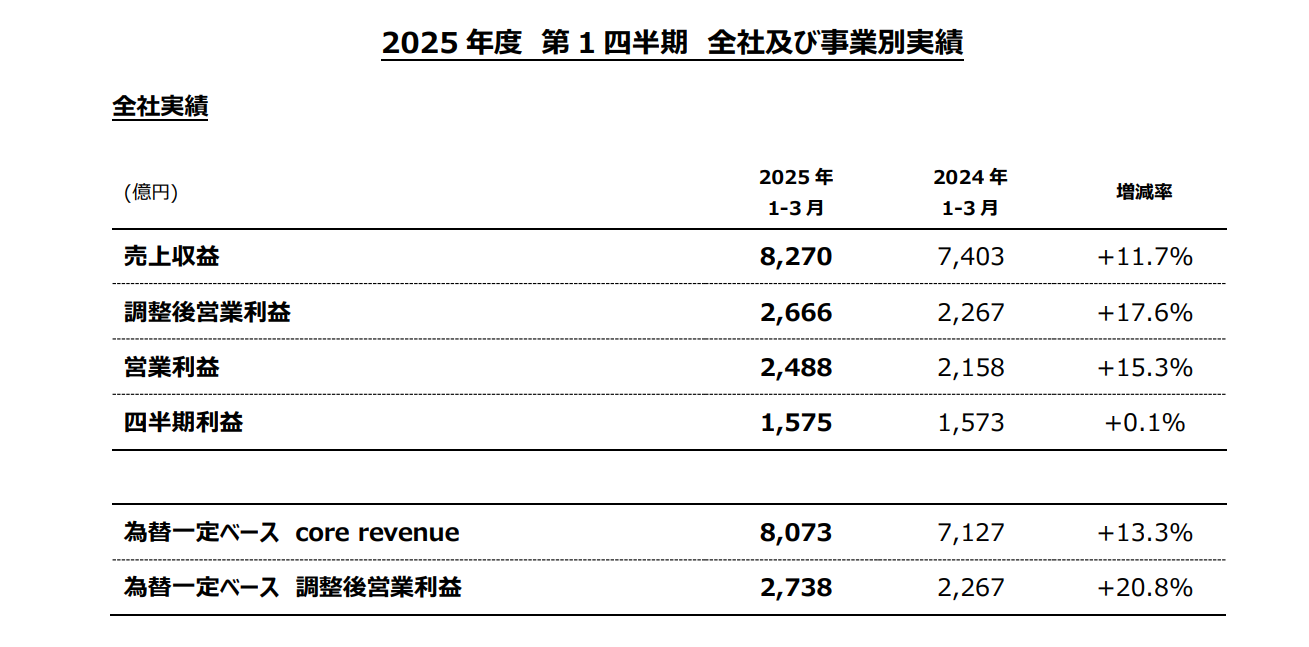

Data shows that JT's sales revenue in the first quarter reached 827 billion yen (about 5.8 billion US dollars), an increase of 11.7% year-on-year. Adjusted operating profit was 273.8 billion yen (about 1.9 billion US dollars), a significant increase of 20.8% year-on-year; net profit attributable to the parent company was 157.5 billion yen (about 1.1 billion US dollars), although it only increased slightly by 0.1% year-on-year, but the overall profit level is still considerable. Management clearly pointed out that the tobacco business is the key force driving profit growth.

2. Tobacco business: New tobacco products are growing rapidly and the market layout is continuously expanding

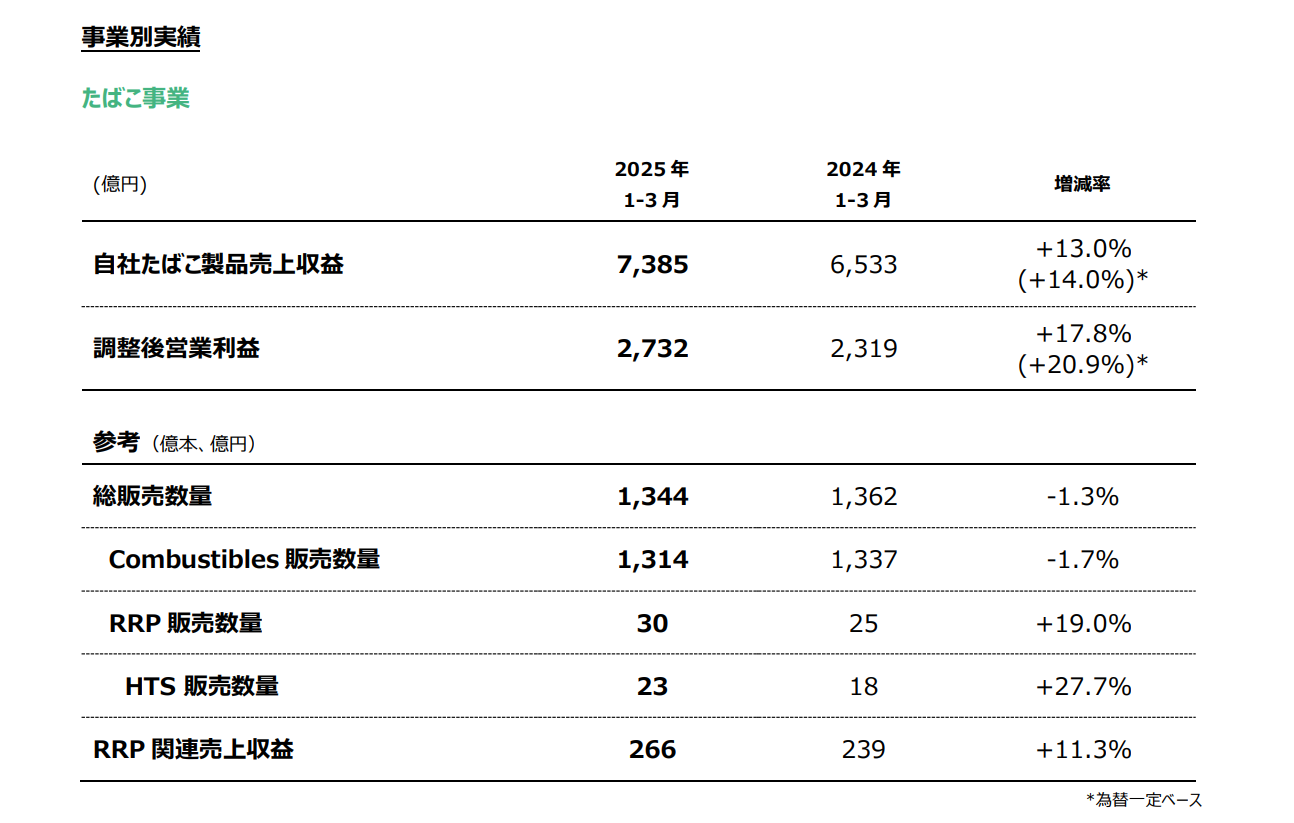

In the first quarter of 2025, the total sales volume of tobacco business was 134.4 billion sticks, which was a year-on-year decrease of 1.3%. However, in terms of subdivision, both conventional tobacco and heated tobacco achieved growth.New tobacco products (RRP) performed particularly well, with sales increasing by 19.0% year-on-year, and heated tobacco products (HTS) increasing by 27.7%.

In the Japanese domestic market, JT's heated tobacco products have achieved a bumper harvest. The sales of both equipment and cartridges have increased, and the market share of the Ploom brand has continued to rise. The company plans to launch new Ploom equipment and cartridges on May 27, which is expected to further consolidate its dominant position in the domestic market and expand its market share.

In overseas markets, JT's heated tobacco products have also achieved remarkable results. In markets such as Russia and the United Kingdom, double-digit sales growth has been achieved. This shows that JT's layout and promotion strategy in overseas markets have achieved remarkable results, and the brand's international influence has continued to increase, laying a solid foundation for further expansion in the global market in the future.

Management also reiterated its mid- to long-term strategic goal of achieving approximately 15% market share in the key heated tobacco market by the end of 2028To achieve this goal, JT will continue to increase investment in research and development, optimize product performance, and enhance user experience. At the same time, it will actively expand sales channels, strengthen market promotion, and enhance brand awareness and reputation.

III. Restructuring of non-tobacco businesses: divesting the pharmaceutical sector and focusing on core businesses

In this financial report, JT announced a major strategic decision: it has reached an agreement with Shionogi Pharmaceutical Co., Ltd. to transfer its pharmaceutical business. The transaction is expected to be completed in the second half of this year, with the transfer of pharmaceutical business expected in December and Torii Pharmaceutical shares expected in September.

JT said that this decision was made because the characteristics of the pharmaceutical business determine that it is more suitable to be operated by pharmaceutical companies that focus on new drug research and development, so as to fully tap the development potential of pharmaceutical assets.After divesting its pharmaceutical business, JT Group will focus on its two core areas: tobacco business and processed food business.As the main source of profit, the tobacco business will continue to play a key role; the processed food business will play a supplementary role in profit growth. The two will develop synergistically to help the Group achieve sustainable development.

IV. Future Outlook: Taking tobacco as the core and steadily advancing the goal

Masamichi Terabata, Director and President of JT, said that the group will rely on the strong performance of the tobacco business to continue to expand the global market penetration of Ploom products and unswervingly advance the market share target for 2028. In the future, JT will increase R&D and innovation efforts in the tobacco business and launch more products that meet market demand; in the processed food business, it will actively explore new growth opportunities, optimize product structure, and enhance product competitiveness.

Source: JT

电子雾化与HNB产品都是新型电子产品,结构虽小,却融合应用多种材料、表面处理、芯片电子等技术工艺,而且雾化技术一直在不断更迭,供应链在逐步完善,为了促进供应链企业间有一个良好的对接交流,艾邦搭建产业微信群交流平台,欢迎加入;Vape e-cigarettes (VAPE) and Heat-Not-Burn e-cigarettes (HNB) are both emerging electronic products. Despite their compact size, they integrate various materials, surface treatment technologies, chip electronics, and other advanced technical processes. Moreover, atomization technology is constantly evolving and the supply chain is being progressively perfected. To facilitate good communication and networking among supply chain enterprises, Aibang has established an industry WeChat group communication platform and warmly welcomes interested enterprises to join.