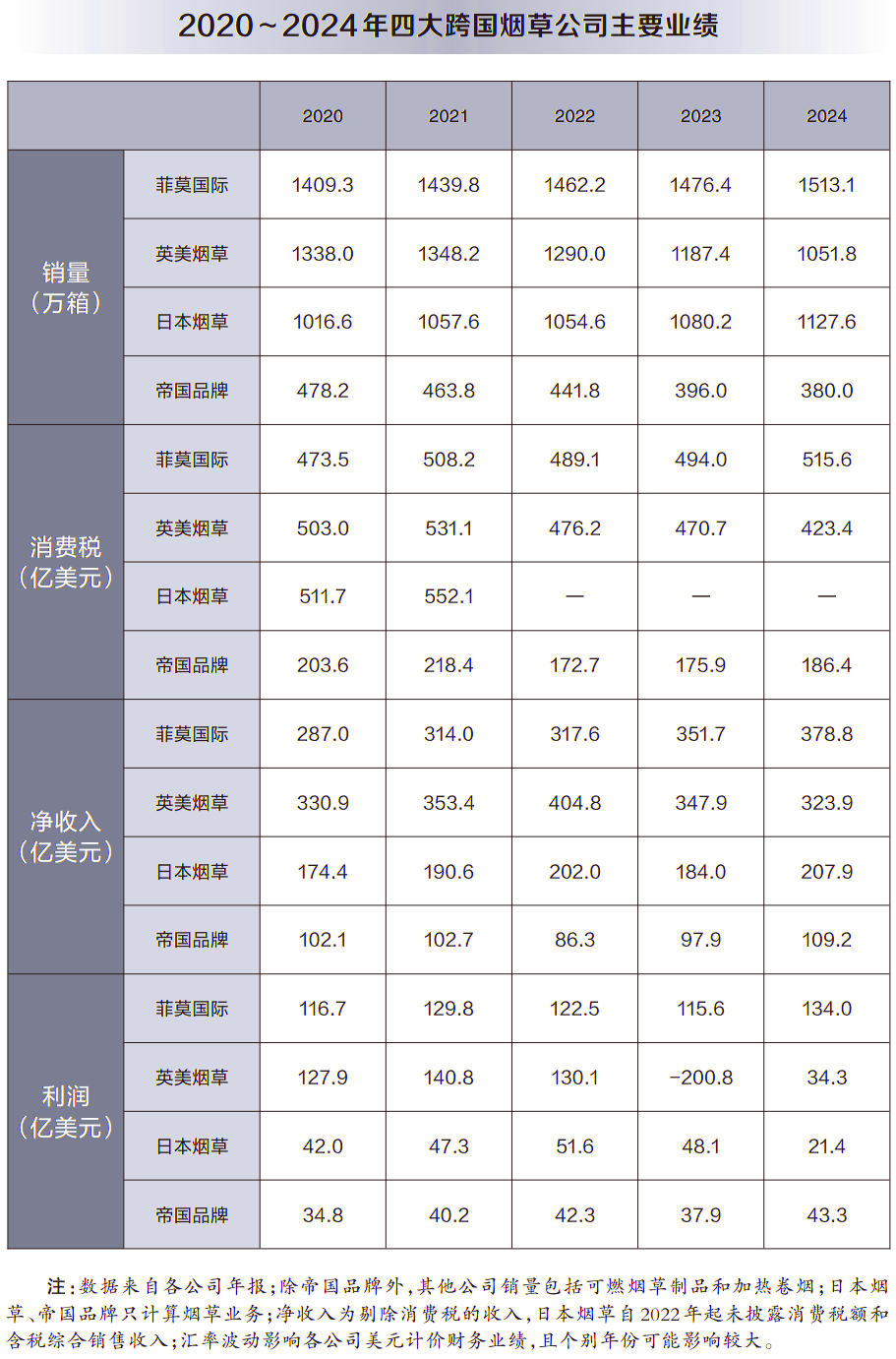

In 2024, the development of various multinational tobacco companies continued to diverge, the market structure continued to evolve, PMI continued to widen the gap with its competitors, and JTI surpassed BAT in terms of sales of combustible tobacco products, and the combined sales of combustible tobacco products and heated cigarettes... Today, let us take a look at the development of major multinational tobacco companies~

a. Financial performance

In 2024, the volume and price of major products increased, and the company's operating performance was good.

b. Main products and brands

In 2024, the total sales volume of cigarettes and heated cigarettes reached 15.131 million boxes , a year-on-year increase of 2.5% and a year-on-year increase of 0.4%.

Cigarettes: Cigarette sales volume was 12.337 million boxes , up 0.6% year-on-year. This was the first time that its cigarette sales volume achieved positive growth after reaching a peak of 18.541 million boxes in 2012 and declining for 11 consecutive years. The growth mainly came from Russia and Turkey; the average price of cigarettes increased by 8.7% year-on-year. In 2024, sales of Marlboro brand cigarettes increased by 3.7% year-on-year to 4.978 million boxes , accounting for 40.3% of the company's total cigarette sales; the five brands of Marlboro, Parliament, Chesterfield, L&M, and Philip Morris accounted for more than 80% of the company's total cigarette sales.

Heated cigarettes: In 2024, 2.794 million boxes of heated cigarettes were sold , a year-on-year increase of 11.5%, but the growth rate has declined for five consecutive years. Sales growth mainly came from the Japanese, Russian and German markets. IQOS products generated net revenue of $11 billion , surpassing cigarette brand Marlboro for the first time; it expanded into five new markets, expanding its market coverage to 76 countries and regions, and the number of IQOS users increased by 3.4 million to 32.2 million .

Electronic cigarettes: VEEV brand e-cigarettes have added 14 new markets, expanding market coverage to 40 countries and regions. In 13 European markets including France, Germany, Greece, and Poland, it has ranked among the top three in local e-cigarette sales, with the number of users reaching 1 million .

Nicotine bags: The sales volume of nicotine bags reached 640 million cans , a year-on-year increase of 52.9%. ZYN brand nicotine pouches are sold in 37 countries and regions, with net revenue exceeding US$2.1 billion . Ranked by net revenue, ZYN has become the number one smokeless tobacco brand in the United States.

c. Business restructuring and adjustment

Optimize business layout.

Sell core assets of the healthcare sector.

Strengthen control over the Egyptian market.

d. US market expansion

Approved by the U.S. Food and Drug Administration (FDA).

Independent promotion of IQOS.

Expand nicotine pouch production capacity.

Plans to sell the cigar business.

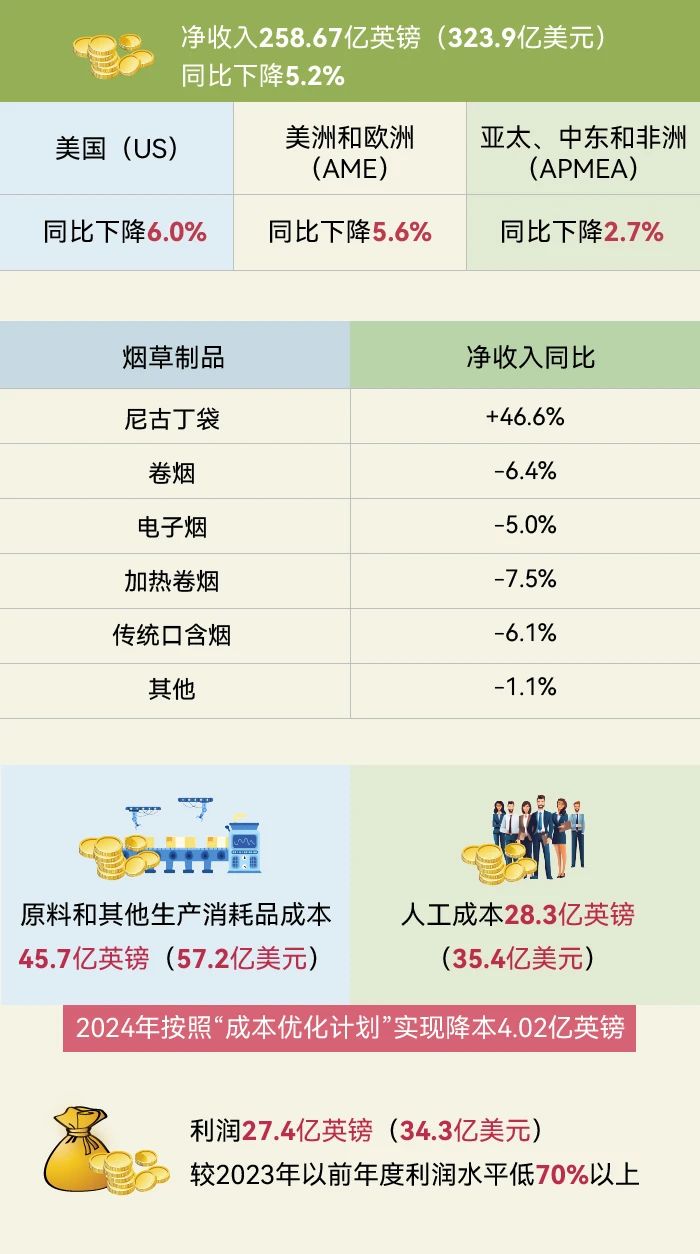

a. Financial performance

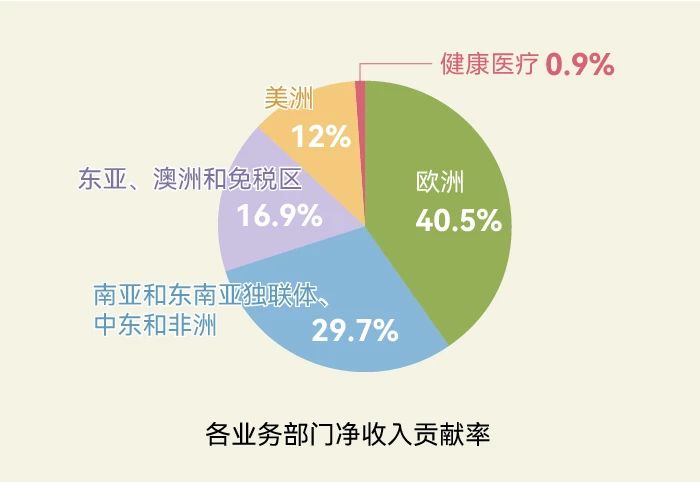

In 2024, the company's operating performance continued to decline under pressure, with some indicators improving and generally in line with expectations.

b. Main products and brands

In 2024, except for nicotine pouches, sales of other products will all decline.

Cigarettes: A total of 10.1 million boxes of cigarettes will be sold in 2024 , a year-on-year decrease of 8.9%. In 2025, the number may fall below 10 million boxes. The main reasons are the withdrawal from the Russian and Belarusian markets and the continued shrinkage of the US cigarette market. Last year, its cigarette sales in the United States fell below one million cartons for the first time, to 940,000 cartons. In 2020, its market covered approximately 180 countries and regions, and by 2024 it had withdrawn from nearly 50 markets.

E-cigarettes: Vuse brand e-cigarettes are sold in 63 countries and regions, and sales have declined for the first time, with annual sales of 616 million units , a year-on-year decrease of 5.9%, accounting for 40% of the world's annual legal e-cigarette sales, a year-on-year decrease of 1.2 percentage points. The company believes that the decline in sales was mainly due to adverse effects such as the proliferation of illegal disposable e-cigarettes in the United States and the flavor ban in Quebec, Canada. The United States is British American Tobacco's largest market for e-cigarettes. The company already has 22 e-cigarettes that have obtained FDA marketing authorization, accounting for 60% of the number of e-cigarettes approved by the FDA.

Heated cigarettes: Sales volume of glo brand heated cigarettes reached 418,000 boxes , down 11.6% year-on-year, the largest drop among all the company's products. The company estimates that its global market share is 16.7%, down 0.4 percentage points year-on-year. The company has improved and upgraded its heated tobacco products, narrowing the gap between glo and Philip Morris International's IQOS. In addition, VEO, the first tobacco-free heated cigarette brand, was launched and has entered 20 markets.

Nicotine pouches: Velo brand nicotine pouches have added 10 new markets, expanding to 44 countries and regions. The sales volume of nicotine bags reached 8.3 billion bags , a year-on-year increase of 55.0%, but the price structure decreased by 2.9% year-on-year. The company's nicotine pouches maintained a leading position in the markets of 21 European countries. In the United States, sales increased by 234% year-on-year to 990 million pouches , thanks to the upgrade of the Velo brand image and the launch of Grizzly, a nicotine pouch brand with the same name as traditional snus. A new factory was built and put into operation in Italy to expand the production capacity of nicotine pouches, and a series of tobacco-free synthetic nicotine pouch patents owned by the American Beni Oral Nicotine Company were acquired for US$30 million. The company expects the global nicotine pouch market size to be comparable to that of e-cigarettes and heated cigarettes by 2030.

Traditional snus: Sales volume fell 8.2% year-on-year to 122,000 boxes , with 90% of sales volume and sales revenue in the US market.

c. Continue to expand beyond nicotine

The company has never given up on looking for opportunities in areas beyond nicotine, and its venture capital firm BTV (Btomorrow Ventures) is a key pillar of investment in areas beyond nicotine. From the first investment in 2020 to the end of 2024, 28 investments have been completed. Most of the first £150 million investment fund has been invested, and the second £200 million new fund was launched in 2024. In 2024, BTV continued to support its portfolio companies and made multiple rounds of follow-up investments.

d. Optimize R&D innovation organization

Optimize the innovation ecosystem. In order to better adapt to future changes in consumer demand, the company has reorganized and upgraded its R&D ecosystem, including 1 global R&D headquarters and innovation ecosystem hub, 3 R&D centers, 3 innovation centers focusing on new product categories such as smoke-free products, 2 product centers, 2 strategic partners, more than 50 development partners, and several open innovation partners.

Establish a public platform for smoke-free scientific research data. The company has established a data platform called Omni, which summarizes its innovative ideas and research results in smoke-free tobacco products, collects smoke-free product data from 82 markets, launches 265 peer-reviewed papers and more than 8,200 authorized patents, and includes 614 related articles from research results outside the company. All the results collected by Omni are shared publicly for reference and use by scientific researchers, regulatory agencies, and the general public.

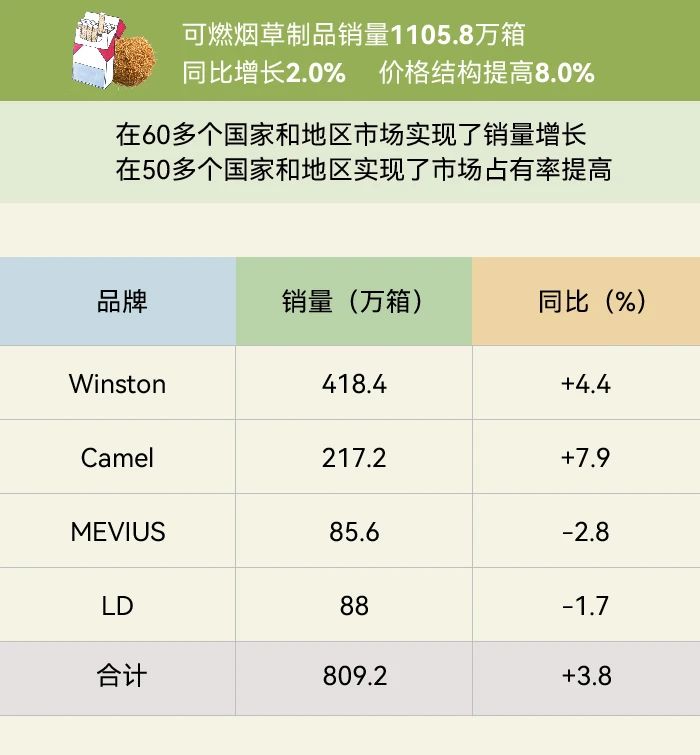

3.JTI

1. Financial performance

In 2024, the market competitiveness was strong, the performance exceeded market expectations, and both revenue and adjusted profit reached historical highs.

b. Product and brand development

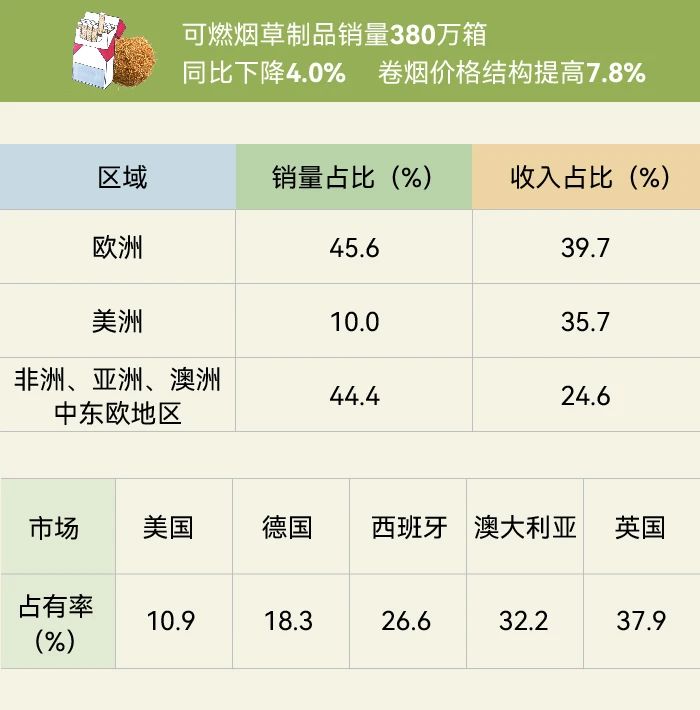

Combustible tobacco products such as cigarettes, tobacco, and mini cigars, and harm reduction products such as heated cigarettes and capsule products are showing a good development momentum, with both volume and price increasing. The sales volume of combustible tobacco products and the total sales volume of combustible tobacco products and heated cigarettes have both exceeded that of BAT.

Harm reduction products: The overall scale of harm reduction products is relatively small, but the market is expanding rapidly and sales volume is growing rapidly. The Ploom brand heated cigarette market has expanded to 24 countries and regions. Sales volume in 2024 is 218,000 boxes , a year-on-year increase of 24.2%, mainly due to the 33.0% year-on-year sales growth of Ploom X in the Japanese market. Its harm reduction products are highly dependent on the Japanese market, with sales in Japan accounting for 82.6% of total sales.

c.Main market performance

d. Acquired the fourth largest tobacco company in the United States

In 2024, the company completed a rare corporate merger and acquisition in the cigarette field in recent years, acquiring Vector Group, the fourth largest cigarette manufacturer in the United States, for a total price of US$2.4 billion. Vector Group was founded in 1873 and has a 5.6% market share in the United States, focusing on the low-price market. In 2023, Vector Group sold 176,000 cartons of cigarettes , had a net income of $1.42 billion , a profit of $330 million , and total assets of $930 million. With this acquisition, the United States became one of JTI top ten markets, and JTI market share in the United States jumped from 2.3% to 8.0%, and it owns two of the top ten brands in the U.S. cigarette market.

4.Imperial Brands

a. Financial performance

In fiscal year 2024 (ending September 30, 2024), the company will advance its consumer-centric transformation strategy and further improve its performance.

b. Product and market performance

In 2024, sales of combustible tobacco products will continue to decline and next-generation products will remain in a cautious expansion stage, but the company believes that all products and major markets show positive signs.

Next-generation products: The company strictly adheres to a prudent market entry strategy and only enters countries and regions where there is already a local consumer base for next-generation products and the company has a strong local cigarette sales channel. Currently, the company's next-generation products have achieved large-scale operation in more than 20 markets in Europe. In eight markets including Greece and Italy, the net revenue from next-generation products accounts for more than 20% of the company's net revenue from local tobacco business. Zone brand nicotine bags drove its performance growth in the US market, new products such as the blu bar disposable e-cigarette that can be inhaled for 1,000 puffs and the blu bar kit with replaceable cartridges drove its performance growth in the European e-cigarette market, and Pulze brand heated cigarettes drove its performance growth in the AAACE market. The company has launched its new tobacco-free, tea-based iSenzia heated cigarette in Italy, Greece, the Czech Republic and Poland.

5.Altria Group

a. Financial performance

b. US market landscape

Altria Group is a tobacco company focused on the US market. The company estimates that there are currently 55 million adult nicotine consumers in the United States, of which 50.9% use only combustible tobacco products, 32.7% use only smokeless products, and 14.5% use a mixture of both products.

It is estimated that the total market size of combustible tobacco products, e-cigarettes, and oral tobacco products in the United States is 6.88 million boxes . Altria Group, BAT, Imperial Brands and JTI share this market.

The United States is the world's largest market for traditional snus and nicotine pouches. In recent years, sales of traditional snus have declined, while the nicotine pouch market has continued to expand rapidly. The market size of all oral products, including traditional snus and nicotine pouches, is 2.07 billion cans .

c. Main products and brands

As many parties value the lucrative profits in the U.S. market and rush into it, Altria has clearly felt the competitive pressure and has accelerated its transformation to smoke-free. However, judging from the failure of its investment in JUUL, its withdrawal from the exclusive sales of IQOS in the U.S., and the slow progress in its cooperation with Japan Tobacco to expand heated cigarettes, the results have not been ideal.

Cigarettes: In recent years, against the backdrop of the overall shrinkage of the U.S. cigarette market, the company's cigarette sales have continued to decline. In 2024, cigarette sales fell 10.2% year-on-year to 1.372 million boxes , and the market share was 45.9%, a year-on-year decrease of 1 percentage point. Marlboro, which accounts for 91.3% of the company's total cigarette sales, sold 1.252 million boxes , a year-on-year decrease of 9.0%. Its market share in the United States was 41.7%, a year-on-year decrease of 0.5 percentage points. Its market share in the US high-end cigarette market was 59.3%, a year-on-year increase of 0.4 percentage points. In addition, the company's sales of Basic, Benson & Hedges, L&M and other brand cigarettes fell 20.4% year-on-year.

Cigars: Sales of the mass-market cigar brand Black & Mild (accounting for 99.8% of the company's cigar sales) were 1.75 billion , down 1.5% year-on-year.

Oral products: The company's sales volume of oral products was 770 million cans , a year-on-year decrease of 1.0%. Among them, the sales volume and market share of traditional snus products are declining; nicotine bag brand on! Sales continued to grow rapidly, increasing by 40.2% year-on-year to 160 million cans , accounting for 8.3% of the U.S. oral products market, an increase of 1.5 percentage points year-on-year. The company is selling on through e-commerce channels and selected retail outlets in Sweden and the UK! and on! PLUS series nicotine bags, opening up the international market.

E-cigarettes: Sales of NJOY electronic cigarette products reached 5 million units , and sales of e-liquid consumables reached 46.6 million units , up 284.6% and 102.6% year-on-year respectively. In 2024, four menthol e-cigarettes under the company's NJOY company obtained FDA marketing authorization. This is the first time that the FDA has authorized non-tobacco flavored e-cigarettes to be marketed. The company lost the lawsuit against JUUL, with the U.S. International Trade Commission ruling in favor of JUUL's patent lawsuit. Altria Group said it would be committed to seeking a solution for the patented products involved.

d.Achievement of smoke-free goals

The company's smoke-free goals for 2028 are: sales of smokeless tobacco products will increase by 35% from 2022 levels; net income will double to US$5 billion from US$2.6 billion in 2022, of which US$2 billion will come from innovative smokeless tobacco products. In 2024, its sales volume of smokeless tobacco products will be close to 820 million units , an increase of only 2.2% from 2022; net revenue from smokeless tobacco products will be US$2.8 billion , of which only US$300 million will come from innovative smokeless products. The company believes that due to the proliferation of illegal disposable e-cigarettes, regulatory enforcement actions have not effectively curbed illegal products, affecting its ability to achieve its 2028 smoke-free goal. To this end, they will update the smoke-free targets after evaluation.

6.KT&G

a. Financial performance

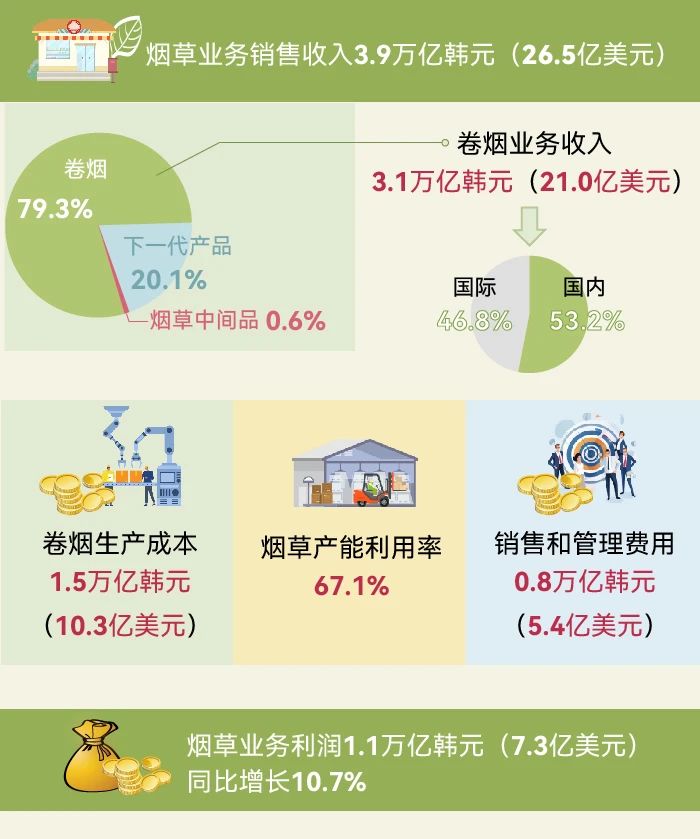

At the beginning of 2024, the company's new board of directors and senior management took office, reversing the trend of four consecutive years of declining profits in the tobacco business.

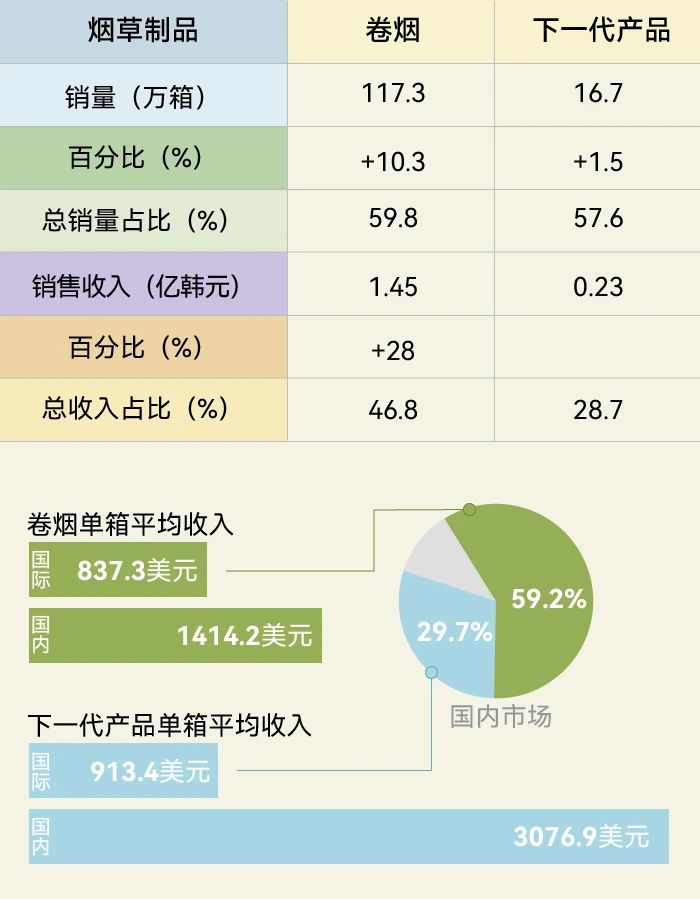

b. Development of the Korean domestic market

The domestic market accounts for a low proportion of sales, but a high proportion of revenue and profits, and is the focus of the company's development. In 2024, domestic cigarette sales fell 2.9% to 790,000 boxes , with sales revenue of 1.65 trillion won ; sales of next-generation products increased 7.7% to 123,000 boxes , with sales revenue of 0.56 trillion won .

The domestic market share of cigarettes has rebounded. Although the company's cigarette sales volume continues to decline, by deepening its presence in the domestic market and continuously launching new products that meet consumer demand, especially the continued growth of "flavor reduction" (i.e. reducing odor and irritating taste) and slim cigarette products, and the increase in the proportion of low-tar (below 2 mg/stick) and high-end products (above 4,500 won/pack), the company's cigarette product market share has increased year by year, reaching 66.7% in 2024.

The next generation of products leads the domestic market. In 2024, the domestic market share of heated tobacco products will be 68%, and the domestic market share of heated cigarettes will further increase to 46%. It is estimated that Philip Morris International sold 114,000 boxes of heated cigarettes in South Korea , with a market share of 43%; British American Tobacco has a market share of 9.9%; Japan Tobacco only sells heated cigarettes in Seoul, with a market share of less than 1%.

c. International market expansion

International Business Department. Currently, the company's international business development department is composed of the Overseas Business Headquarters, Asia-Pacific Headquarters, and Eurasia Headquarters. The Overseas Business Headquarters consists of 5 offices and 13 teams. Each regional headquarters has functional organizations and overseas legal persons or operating branches. There are 11 overseas legal persons operating in Indonesia, Russia, Turkey and other places, and operating branches have been established in Mongolia, Europe and other places.

Cigarette exports and overseas production and sales go hand in hand. Implement a dual-wheel drive of exports and overseas production, improve profitability through the overseas legal person direct sales model, stabilize the operating business portfolio, and conduct indirect distribution business through importers; actively expand the coverage of the distribution network in the developed markets to lay a solid foundation for medium- and long-term growth; formulate differentiated strategies according to market segments and market development stages; strictly abide by the regulatory requirements of various countries for marketing and promotion; launch differentiated products and brands such as clove type, flue-cured tobacco type, and popping bead type that meet market demand to enhance brand competitiveness. Since 2015, the company's cigarette sales in the international market have exceeded domestic sales, reaching a historical high in 2024. On the basis of consolidating sales in the original main markets such as the Middle East and the CIS, the export areas will be expanded to Asia-Pacific, Africa, Central and South America and other regions. At the same time, it has stepped up its efforts to manufacture and sell cigarettes overseas, and built new global production bases in Indonesia and Kazakhstan. Indonesia is its largest overseas market.

The international expansion of next-generation products is highly tied to PMI . Strengthened cooperation with PMI by authorizing it to sell the company's next-generation products in markets outside of Korea. In July 2024, a new memorandum of understanding was reached with Philip Morris International to cooperate in promoting KT&G new heated cigarettes in the United States and jointly promote its heated cigarettes to obtain marketing authorization in the United States. The company's next-generation products have been launched in 34 countries including Russia, Japan, and Italy, and will continue to expand into more markets in the future. However, from the actual results, the market expansion did not bring much sales growth. The company's major shareholders believed that the company's products actually became a foil to IQOS and were quite dissatisfied with the cooperation between the company and PMI.

source:https://mp.weixin.qq.com/s/QeW_zAEEN-5ttOplDZ8vsA

电子雾化与HNB产品都是新型电子产品,结构虽小,却融合应用多种材料、表面处理、芯片电子等技术工艺,而且雾化技术一直在不断更迭,供应链在逐步完善,为了促进供应链企业间有一个良好的对接交流,艾邦搭建产业微信群交流平台,欢迎加入;Vape e-cigarettes (VAPE) and Heat-Not-Burn e-cigarettes (HNB) are both emerging electronic products. Despite their compact size, they integrate various materials, surface treatment technologies, chip electronics, and other advanced technical processes. Moreover, atomization technology is constantly evolving and the supply chain is being progressively perfected. To facilitate good communication and networking among supply chain enterprises, Aibang has established an industry WeChat group communication platform and warmly welcomes interested enterprises to join.