Today, against the backdrop of a shrinking traditional cigarette market and an intensifying global tobacco control movement, new tobacco products are rapidly emerging, marketed as "harm-reducing alternatives."

From heat-not-burn (HNB) to vaporized e-cigarettes, from smokeless tobacco to oral nicotine delivery, new tobacco products are reshaping the global tobacco industry through technological innovation and enhanced consumer experience.

However, behind this seemingly irreversible transformation lies a complex web of health controversies, regulatory jockeying, and market restructuring. Will new tobacco products truly dominate the future? The answer may be far more complex than it appears.

I. The Rise of New Tobacco Products: A Dual Play of Technology Driven by Market Demand

Technological Iteration: The Revolution from "Combustion" to "Heating"

It is well known that the harmful effects of traditional cigarettes primarily stem from the tar, carbon monoxide, and over 7,000 chemicals produced during combustion, 69 of which are known carcinogens. The core breakthrough of new tobacco products lies in "eliminating combustion":

HNB (heat-not-burn): Heat tobacco sheets at temperatures below 350°C release nicotine and aroma, reducing the production of harmful substances such as tar. Philip Morris International's IQOS series has received FDA approval, authoritatively endorsed for its harm reduction benefits. Japan Tobacco's PloomAURA utilizes multi-mode heating technology, increasing the number of uses per charge to 27, significantly improving the user experience.

Atomized e-cigarettes: These use e-liquid (containing nicotine, propylene glycol, glycerin, etc.) and generate vapor through atomizer coils. While their harm reduction benefits are controversial, some studies show that e-cigarette users are exposed to over 90% lower levels of carcinogens than traditional cigarettes.

Smokeless innovations: These include snus, nicotine pouches (such as Swedish Match's Zyn), and oral nicotine products, which completely eliminate the inhalation process and further reduce health risks.

Market Demand: Traditional Smokers' Urgent Need for Harm Reduction and Young People's Fashion Choice

Conversion of Traditional Smokers: Global cigarette sales will decline from 5.75 trillion sticks in 2015 to 5.16 trillion sticks in 2024, while the HNB market will leap from US$13.5 billion in 2019 to US$37.1 billion in 2024, achieving an 18% compound annual growth rate. Japan, the world's largest HNB market, will see a 48% penetration rate in 2025, while Rome, Italy, will see a 31% penetration rate, demonstrating the potential for substitution in mature markets.

Attracting Young People: Vaping e-cigarettes are rapidly gaining popularity among teenagers thanks to their diverse flavors (such as fruit and mint) and fashionable designs. Despite tightening regulations in various countries (such as the US ban on flavored e-cigarettes), global vaping users will still exceed 120 million in 2024, 30% of whom are under 30 years old.

Capital and Policy: Tobacco Giants' "Smoke-Free Transformation" and Governments' "Balance of Tobacco Control"

Large Companies' Strategies: Philip Morris International plans to have smoke-free products account for over two-thirds of its revenue by 2030, British American Tobacco aims for new tobacco revenue to reach 50% by 2035, and Japan Tobacco projects a 10%-15% market share for HNB products in 2028. Supply chain companies such as Smoore International and Yingqu Technology are sharing in the industry's dividends through technology integration (such as providing heating chips for IQOS).

Policy Game: 133 countries worldwide have regulated or banned e-cigarettes, but HNB products have received support from some governments due to their harm reduction benefits. For example, Japan allows HNB sales and imposes high tobacco taxes. While China has not liberalized its domestic HNB market, China National Tobacco Corporation has accelerated research and development. As early as 2020, the number of domestic HNB brands has increased from a handful to nearly 100.

II. Controversies surrounding new tobacco products: Health risks, regulatory loopholes, and ethical dilemmas

Health risks: Harm reduction does not equal harmlessness

Residual hazards: Although HNB reduces tar, it still contains harmful substances such as nitrosamines and heavy metals. An internal study by Philip Morris International shows that IQOS users have a 50% lower risk of lung cancer than traditional smokers, but it is still 10 times higher than non-smokers.

E-cigarette hazards: Although the concentrations of carcinogens such as formaldehyde and acetaldehyde in e-cigarette vapor are lower than those in cigarettes, long-term inhalation can cause chronic obstructive pulmonary disease (COPD) and cardiovascular disease. In 2019, the "E-cigarette-associated lung injury" (EVALI) outbreak in the United States resulted in nearly 2,000 cases and 37 deaths.

Adolescent addiction: Nicotine irreversibly damages adolescent brain development and can lead to learning disabilities and anxiety disorders. The World Health Organization warns that adolescents who use e-cigarettes are twice as likely to become addicted to tobacco in the future.

Regulatory loopholes: Gray areas and transnational competition

Lack of standards: The global regulatory framework for new tobacco products has yet to be unified. For example, China has regulated HNB as a cigarette, but the US FDA took five years to approve IQOS, and disposable e-cigarettes remain outside of regulation.

Illegal Trade: Globally, over 1 billion illegal e-cigarettes were seized in 2023, primarily targeting the youth market. Taiwan Province conducted 710,000 e-cigarette and heated tobacco inspections in 2023, resulting in fines totaling approximately 500 million RMB, highlighting the challenges of law enforcement.

Transnational Marketing: Tobacco giants promote e-cigarettes through social media platforms such as Instagram and TikTok, using "healthy" and "fashionable" rhetoric to attract young people. Despite bans on online sales in many countries, underground transactions and cross-border purchasing agents continue to persist.

Ethical Dilemma: The Conflict Between Public Health and Commercial Interests

Misleading Harm Reduction Marketing: Some companies exaggerate the harm reduction effects of new tobacco products, even claiming them to be "harmless." For example, Ruyan, exposed by CCTV for falsely claiming to help quit smoking, ultimately withdrew from the Chinese market.

Tax Dependence: The tobacco industry contributes over $300 billion in global tax revenue annually, and the rise of new tobacco products could impact traditional tax systems. The government needs to strike a balance between tobacco control goals and fiscal revenue, leading to policy fluctuations.

Social Equity: The high prices of new tobacco products (e.g., IQOS devices cost approximately $50) may exacerbate the wealth gap, with low-income groups still relying on cheap traditional cigarettes while high-income groups turn to "reduced-harm" products.

III. Future Outlook: Can New Tobacco Products Dominate the Market?

1. Short-Term (2025-2030): Technological Iteration and Market Differentiation

Accelerated HNB Penetration: With the successful trial launch of Philip Morris International's IQOS in the United States, HNB penetration in the United States is expected to reach 30% by 2029, corresponding to an additional 33.8 billion cigarettes. Emerging markets (such as Eastern Europe, the Middle East, and Africa) will become growth engines. Philip Morris International's HNB products already have a market share exceeding 30% in Budapest, Athens, and other markets.

Tightening E-cigarette Regulation: Global regulation of e-cigarettes will tighten further, with flavor restrictions, packaging warnings, and tax increases becoming the norm. For example, after China banned the sale of flavored e-cigarettes in 2022, the market size plummeted from 19.6 billion yuan in 2021 to 1.986 billion yuan in 2023.

The Rise of Smokeless Products: Oral nicotine (such as nicotine pouches) is growing rapidly due to its high concealment and harm reduction properties. The compound annual growth rate (CAGR) from 2019 to 2024 reached 77.1%, and the market size is expected to exceed US$20 billion in 2030.

2. Medium-Term (2030-2040): Health Consensus and Industry Restructuring

Harm Reduction Standard Harm Reduction Standards: A global harm reduction certification system for new tobacco products may be established to clarify the harm reduction ratings of products like nicotine-based tobacco products and e-cigarettes, guiding consumers in making informed choices.

The Decline of Traditional Tobacco: If global cigarette sales decline at an average annual rate of 1%, the cigarette market will shrink to below 4 trillion sticks by 2040, with new tobacco products potentially accounting for over 50% of the total.

Technological Breakthroughs: The maturation of technologies such as low-temperature heating and combustion-free atomization could completely eliminate the production of harmful substances, bringing new tobacco products closer to "harmless" standards. For example, Philip Morris International is developing "smokeless" technology, which aims to reduce harmful substance emissions to one-tenth of those of traditional cigarettes.

3. Long-Term (Post-2040): Social, Cultural, and Ethical Restructuring

The Decline of Smoking Culture: With rising health awareness and the popularity of new tobacco products, smoking may shift from a "social habit" to a "personal choice," further expanding the scope of smoking bans in public places.

Escalating Ethical Controversy: If new tobacco products are proven to still pose long-term health risks, governments may strengthen regulation or even ban their sale, potentially leading to a recurrence of events similar to the "e-cigarette crisis."

Competition from Substitutes: The legalization of marijuana and emerging products such as synthetic nicotine may divert market share from the new tobacco market, creating a diversified competitive landscape.

In summary: The future of new tobacco products depends on humanity's ultimate health choices.

The author believes that the rise of new tobacco products is the result of technological advancement, market demand, and policy maneuvers. However, whether they can truly dominate the market depends on three key factors:

First, the ultimate verification of health risks: If scientific evidence proves that new tobacco products pose significantly less long-term harm than traditional cigarettes, their market position will be consolidated; otherwise, they may face regulatory crackdowns and a collapse of consumer trust.

Second, the improvement of the regulatory framework: Globally, unified and strict harm reduction certification and regulatory standards must be established to eliminate false advertising and illegal trade, protecting youth and non-smokers.

Third, social and cultural shifts: Only when "smoke-free living" becomes a mainstream value in our society can new tobacco products be upgraded from "alternatives" to "necessities."

Our point is: the future may not belong to new tobacco products, but it will definitely belong to healthier choices. In this transformation of tobacco production and consumption, the maneuvering between technology, market forces, and policies will ultimately converge on a core question: Can humanity enjoy nicotine while completely freeing itself from the harmful effects of tobacco? The answer is still on the way...

Source: Tobacco Online Authors: Ke Xin, Xiao Ting

https://www.tobaccochina.com/html/news/xxyc/697398.shtml

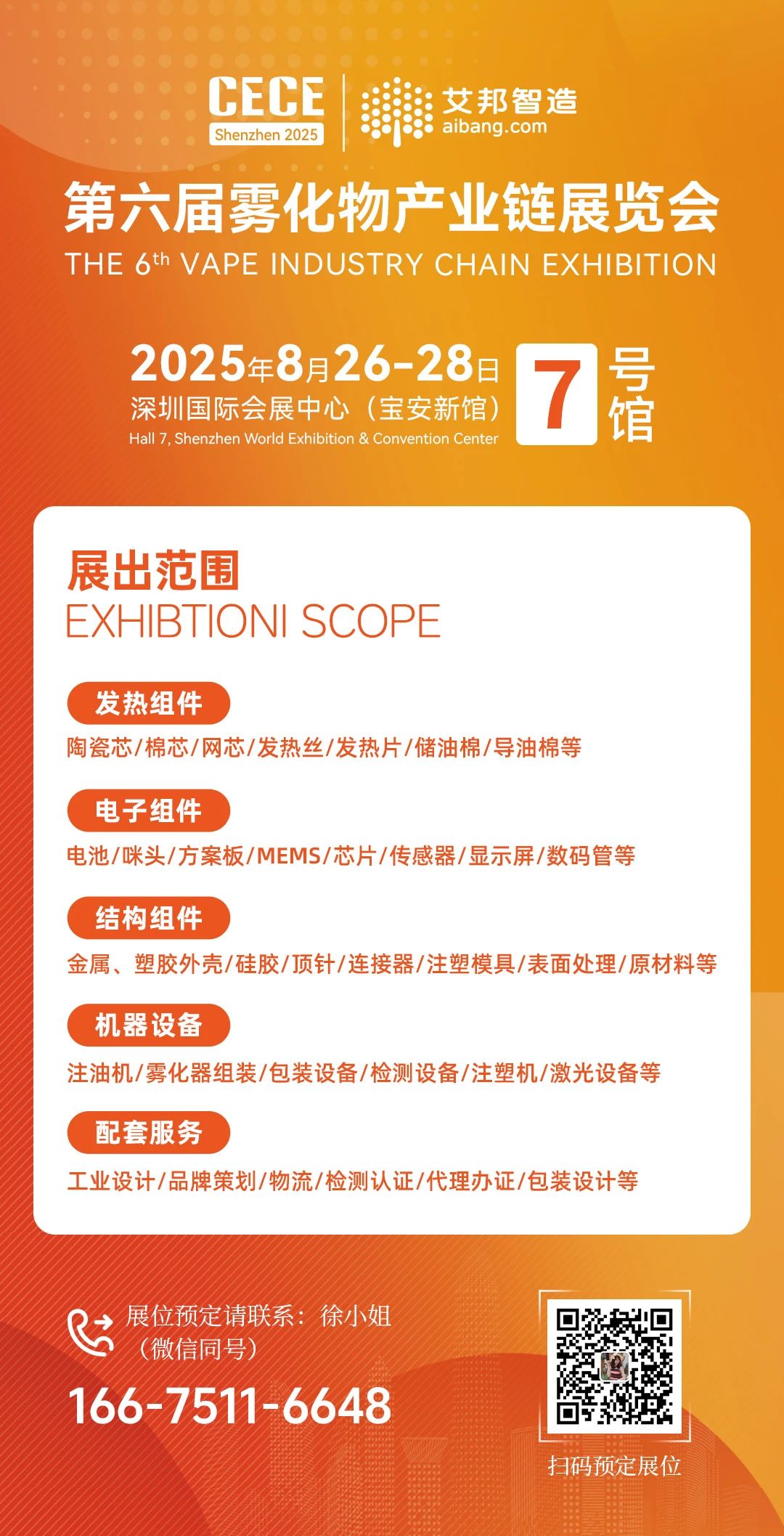

Recommended Events

电子雾化与HNB产品都是新型电子产品,结构虽小,却融合应用多种材料、表面处理、芯片电子等技术工艺,而且雾化技术一直在不断更迭,供应链在逐步完善,为了促进供应链企业间有一个良好的对接交流,艾邦搭建产业微信群交流平台,欢迎加入;Vape e-cigarettes (VAPE) and Heat-Not-Burn e-cigarettes (HNB) are both emerging electronic products. Despite their compact size, they integrate various materials, surface treatment technologies, chip electronics, and other advanced technical processes. Moreover, atomization technology is constantly evolving and the supply chain is being progressively perfected. To facilitate good communication and networking among supply chain enterprises, Aibang has established an industry WeChat group communication platform and warmly welcomes interested enterprises to join.