Recently, the Ministry of Finance and the State Taxation Administration officially issued the "Announcement on Adjusting the Export Tax Rebate Policy for Photovoltaic and Other Products" (Announcement No. 2 of 2026 by the Ministry of Finance and the State Taxation Administration), making significant adjustments to the value-added tax export tax rebate policy for photovoltaic, e-cigarette and other products. The relevant new regulations will be gradually implemented from April 1, 2026.

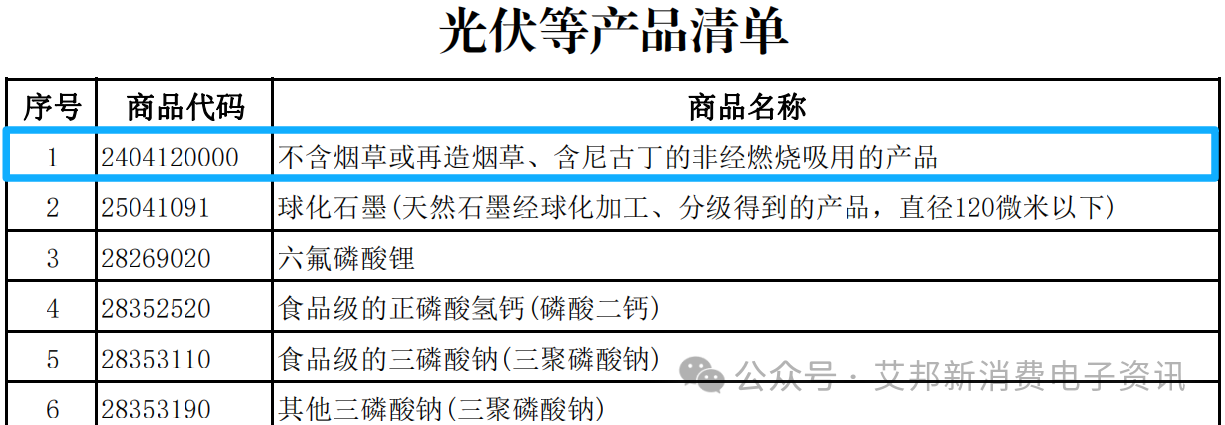

This policy adjustment explicitly includes e-cigarette-related products in the list of products for which VAT export tax rebates will be cancelled, specifically involving two key product categories:

-

Product code 2404120000 corresponds to "non-combustion products containing nicotine that do not contain tobacco or reconstituted tobacco," covering disposable e-cigarettes, cartridges, e-liquids, etc. -

Product code 8543400090 corresponds to "other electronic cigarettes and similar personal electronic atomization devices" , including smoking accessories, open-system devices, etc.

Announcement on Adjusting Export Tax Rebate Policies for Photovoltaic Products and Other Products

Announcement No. 2 of 2026 issued by the Ministry of Finance and the State Taxation Administration

The following announcement is made regarding the adjustment of export tax rebate policies for photovoltaic and other products:

I. Effective April 1, 2026, export VAT rebates for photovoltaic and other related products will be cancelled. See Annex 1 for a detailed product list.

II. From April 1, 2026 to December 31, 2026, the VAT export tax rebate rate for battery products will be reduced from 9% to 6%; from January 1, 2027, the VAT export tax rebate for battery products will be cancelled. See Annex 2 for a detailed product list.

Third, for the products subject to consumption tax among the above-mentioned products, the export consumption tax policy will not be adjusted, and the consumption tax refund (exemption) policy will continue to apply.

IV. The export tax rebate rate applicable to the products listed in this announcement shall be determined by the export date indicated on the export customs declaration.

This is to announce.

Attachment: 1. List of photovoltaic and other products

2. Battery Product List

Ministry of Finance and State Taxation Administration

January 8, 2026

Source: https://szs.mof.gov.cn/zhengcefabu/202601/t20260109_3981637.htm?sessionid=

电子雾化与HNB产品都是新型电子产品,结构虽小,却融合应用多种材料、表面处理、芯片电子等技术工艺,而且雾化技术一直在不断更迭,供应链在逐步完善,为了促进供应链企业间有一个良好的对接交流,艾邦搭建产业微信群交流平台,欢迎加入;Vape e-cigarettes (VAPE) and Heat-Not-Burn e-cigarettes (HNB) are both emerging electronic products. Despite their compact size, they integrate various materials, surface treatment technologies, chip electronics, and other advanced technical processes. Moreover, atomization technology is constantly evolving and the supply chain is being progressively perfected. To facilitate good communication and networking among supply chain enterprises, Aibang has established an industry WeChat group communication platform and warmly welcomes interested enterprises to join.