1. Before 2003: Early Concepts of E-Cigarettes

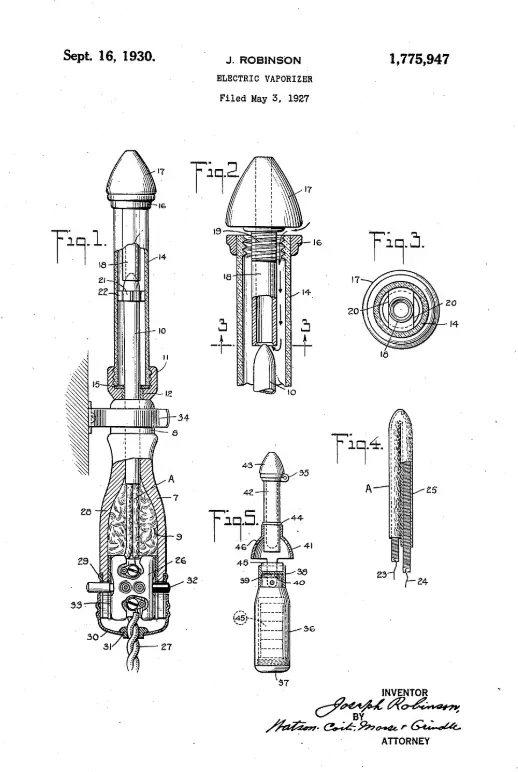

In 1927, American Joseph Robinson patented the first electric vaporizer, claiming it could be used to atomize medications, making it easier for people to inhale the vapor without the risk of burns. However, Robinson did not commercialize his patent.

Although Joseph Robinson's electric vaporizer wasn't designed to vaporize tobacco, its creation may have provided inspiration for Herbert A. Gilbert's later smokeless cigarette design.

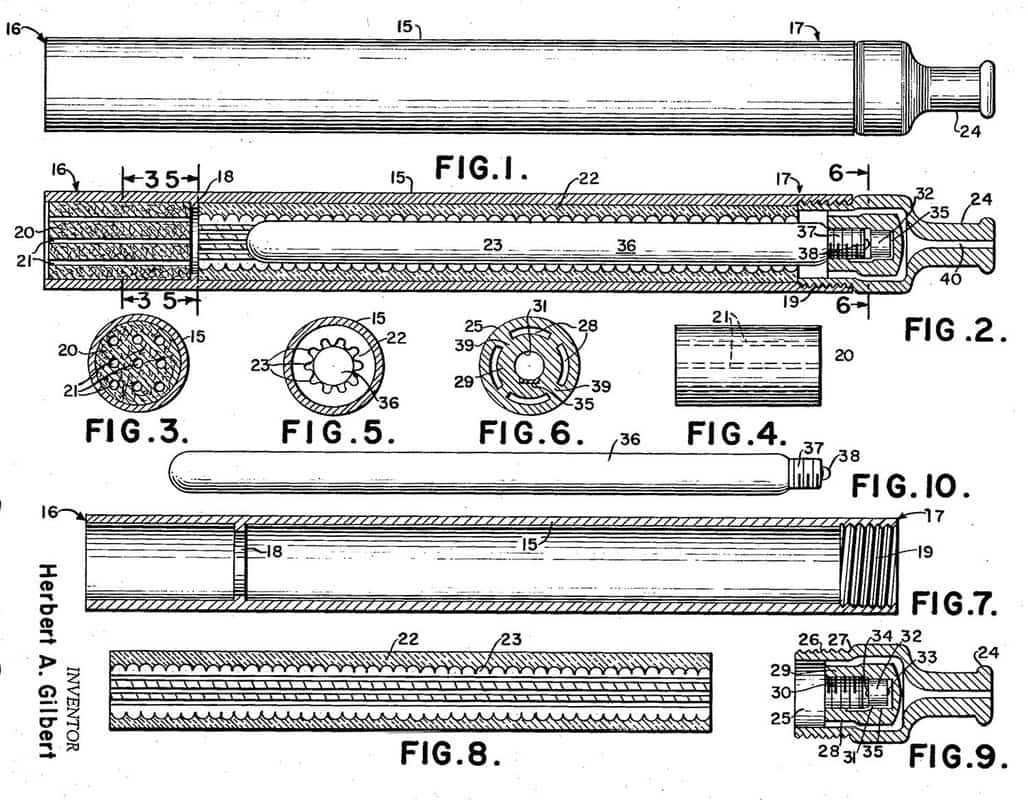

In 1963, American worker Herbert A. Gilbert applied for a patent for an electronic smoking device. His smokeless cigarette design claimed to "replace paper and burning tobacco with heated, moist, and flavored air."

Unfortunately, this invention was too advanced. Although companies were willing to invest in it, there was no market demand at the time, and it ultimately failed to achieve commercialization.

2.2003-2009: The First Commercialized E-Cigarette

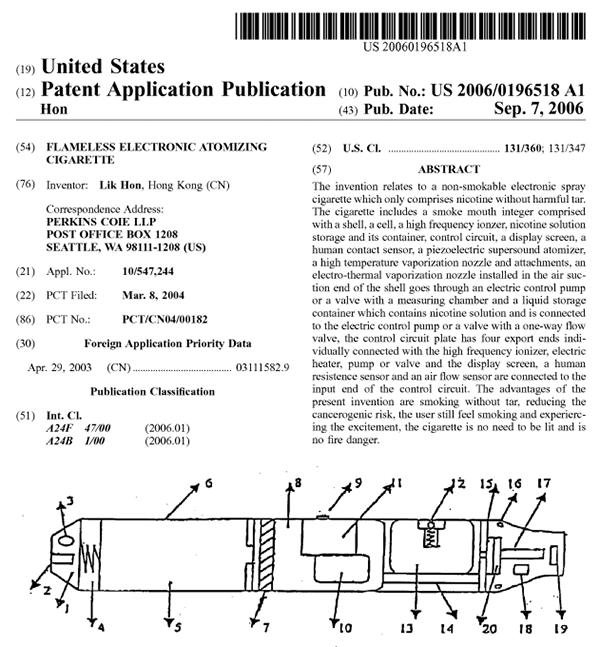

In 2001, Chinese pharmacist Hon Lik invented the first nicotine-based e-cigarette, which used ultrasonic technology to atomize a solution containing propylene glycol, nicotine, and other ingredients.

In 2003, Hon Lik applied for and received a patent for a "non-combustible electronic atomizing cigarette." He subsequently founded a company to commercialize the product under the brand "Ruyan." Hon Lik is widely considered the inventor of the e-cigarette.

韩力(Hon Lik)

韩力(Hon Lik)

Ruyan product information picture

In December 2006, Jinlong Group acquired the e-cigarette business from one of its shareholders, Han Li. In November 2007, Jinlong Group announced a name change to Ruyan Group, with its market capitalization reaching nearly HK$120 billion. In 2008, Ruyan's sales reached 1 billion RMB, with global sales exceeding 300,000 cigarettes.

But Ruyan's success was short-lived. Starting in 2008, Ruyan faced public pressure in China due to publicity issues, and its overseas development suffered setbacks. Just one year later, in 2009, Ruyan suffered a full-year loss of 444 million RMB.

In 2013, after four consecutive years of losses, Imperial Tobacco acquired Ruyan for US$75 million, including its e-cigarette patents. Han Li also served as a research and development consultant for Fontem Ventures, an e-cigarette company under Imperial Tobacco.

3. 2003-2018: The Rapid Expansion of the E-cigarette Industry

As the saying goes, when a whale falls, all things come to life. While e-cigarettes may have been a short-lived phenomenon, the commercialization of e-cigarettes has fostered a remarkably resilient industry.

- The Explosion of the Overseas E-cigarette Consumer Market

In 2005, Ruyan Technology began exporting its e-cigarette products overseas; in 2006, e-cigarettes began to be sold and used in Europe; and in 2007, after becoming popular in the European market, e-cigarettes quickly entered the US market.

In September 2008, the WHO announced that it did not consider e-cigarettes to be the most effective smoking cessation aid. US e-cigarette regulation subsequently tightened. In March 2009, the FDA regulated e-cigarettes as medical devices, prohibiting their import. This hindered the development of the industry and slowed market growth.

In April 2009, Smoking Everywhere filed a lawsuit in federal court, arguing that e-cigarettes were tobacco and therefore beyond the FDA's jurisdiction. At the end of 2010, a federal district court and the Washington Court of Appeals ruled against the FDA, declaring that the FDA could only regulate e-cigarettes as tobacco products. The following year, the FDA announced that it would regulate e-cigarettes under the Food, Drug, and Cosmetic Act.

After the FDA lost the case in 2010, the U.S. e-cigarette market was opened up. Shenzhen, relying on its advantages in the electronics and foreign trade industry chain, quickly saw the emergence of a number of e-cigarette OEM factories, which took on a large number of orders from overseas, especially the United States, and gradually formed an e-cigarette industry cluster in Songgang and Shajing areas of Bao'an District, Shenzhen.

Many established e-cigarette companies were established between 2009 and 2013, including McWel, First-Purpose, Aolin, Yijiate, Green Yunda, Xinyikang, Kanger, Zhuoeryue, Kimree, Klaipeng, Wulun Technology, and Jieshibo.

In 2014, China had over 2,000 e-cigarette factories, producing 90% of the world's e-cigarettes, a level that has remained stable since then. Roughly half of these products are sold in the United States, and one-third are sold in Europe.

- The sudden emergence of e-cigarettes in China

From a consumer market perspective, the period from 2003 to 2008 marked the initial development phase, with both domestic and international markets. The period from 2009 to 2018 marked a period of rapid expansion, with the market concentrated overseas and the domestic market largely absent.

However, in 2018-2019, e-cigarettes suddenly became a hot topic in China, with a large number of e-cigarette brands, such as RELX and YOOZ, establishing themselves. Based on various sources, two main factors contributed to the e-cigarette boom at the time: high profits and high product repurchase rates.

In particular, in December 2018, a piece of news went viral on social media: [US e-cigarette company hands out $2 billion in year-end bonuses, $1.3 million per person!]

What company is so extravagant and inhumane?

It turned out that the US e-cigarette company Juul Labs planned to distribute $2 billion in special dividends to all 1,500 employees as year-end bonuses. This averaged $1.3 million (approximately RMB 8.95 million) per person.

Juul first appeared on the US market in 2015, but by 2016, its sales had soared 700%. By September 2018, Juul had captured 72% of the US e-cigarette market, with sales reaching $2 billion that year.

At the time, Juul's valuation was $38 billion, surpassing SpaceX. At the end of 2018, US tobacco giant Altria acquired a 35% stake in JUUL for $12.8 billion. With the newly raised funds, Juul generously offered employees a wave of benefits, leading to the million-dollar year-end bonus phenomenon.

Unlike the European and American markets, e-cigarettes disappeared from the Chinese market after Ruyan's decline in 2008. By 2018, many people considered e-cigarettes to be imported goods.

In 2018, the domestic e-cigarette consumer market was completely blank, making it a lucrative opportunity for brands. Buoyed by million-yuan year-end bonuses, domestic brands were filled with hope and enthusiasm.

In the first half of 2019, domestic e-cigarette brands mushroomed, and funding rounds continued. According to incomplete statistics, over 35 e-cigarette investment projects were completed in the first half of 2019, with 18 financings exceeding 10 million yuan, totaling over 1 billion yuan.

However, the domestic boom was short-lived. On October 30, 2019, the "Notice on Further Protecting Minors from E-cigarette Harm" was officially issued, and the online e-cigarette sales ban came into effect.

Thus, e-cigarettes entered a period of strict regulation, moving from a period of rapid expansion.

4. 2019 to Present: The Beginning and Strengthening of the Regulatory Era

The rapid development of e-cigarettes has attracted the attention of relevant organizations in various countries and regions around the world, and has also caused a lot of controversy. The biggest controversy is the product's temptation to teenagers. A typical case is that JUUL was caught in a whirlpool of public opinion due to the problem of attracting teenagers, and its valuation continued to decline.

Based on the consideration of protecting young people, countries around the world have regulated e-cigarettes.

- Regulatory Policies in Major Overseas Consumer Markets

In August 2016, the US FDA issued the Tobacco Products Control Act, which came into effect on August 8, 2016. This law requires new tobacco products to pass the PMTA before they can be legally marketed and strengthens regulations to prevent youth use of e-cigarettes. Tightened regulations in February 2020 significantly increased industry compliance costs.

In the EU, e-cigarettes are regulated and managed as recreational consumer products. Starting in 2016, e-cigarettes and related products will be subject to Article 20 of the TPD.

- Domestic Regulatory Policies

Following the online e-cigarette sales ban issued in October 2019, the State Tobacco Monopoly Administration (STOMA) released an announcement on its official website on March 11, 2022, regarding the "E-Cigarette Management Measures," which will take effect on May 1, 2022.

On April 12, 2022, the mandatory national standard for e-cigarettes (GB 41700-2022) was officially released, taking effect on October 1, 2022.

With the introduction of the management measures and national standard, e-cigarette factories will need to obtain a license before production and register on a unified trading platform. The domestic e-cigarette industry has officially entered an era of compliance.

5. Conclusion

In conclusion, for the e-cigarette industry, the era of strict regulation does not mark the end of the industry. On the contrary, it marks the beginning of a longer-term future, and the market continues to grow.

Unlike the previous period of ruthless expansion, the e-cigarette industry in this era of strict regulation requires greater technological innovation to develop products that meet regulatory policies and market demands. Again, for the e-cigarette industry, change is the only constant. This presents challenges, but also opportunities.

来源:综合整理

电子雾化与HNB产品都是新型电子产品,结构虽小,却融合应用多种材料、表面处理、芯片电子等技术工艺,而且雾化技术一直在不断更迭,供应链在逐步完善,为了促进供应链企业间有一个良好的对接交流,艾邦搭建产业微信群交流平台,欢迎加入;Vape e-cigarettes (VAPE) and Heat-Not-Burn e-cigarettes (HNB) are both emerging electronic products. Despite their compact size, they integrate various materials, surface treatment technologies, chip electronics, and other advanced technical processes. Moreover, atomization technology is constantly evolving and the supply chain is being progressively perfected. To facilitate good communication and networking among supply chain enterprises, Aibang has established an industry WeChat group communication platform and warmly welcomes interested enterprises to join.