Since last year, many countries around the world have introduced new regulations on traditional tobacco products and new tobacco products, such as e-cigarettes. Tobacco regulation varies across countries, with some policies providing opportunities for business development and others posing challenges in adapting to the market environment.

Europe: Implementation of Flavor Restrictions and Bans on Disposable E-Cigarettes

Last year, several European countries introduced a number of restrictive measures that impacted both the cigarette and e-cigarette markets. Belgium, France, and Poland banned the sale of disposable e-cigarettes. Countries like Latvia and Slovenia restricted e-cigarette liquid flavors, allowing only tobacco and menthol flavors. These policies aim to reduce the appeal of e-cigarettes to minors, but they may also affect adult consumers. Disposable e-cigarettes are popular for their convenience, and flavor restrictions may reduce their appeal to some consumers.

The UK has introduced a ban on disposable e-cigarettes. E-cigarette companies believe the ban could drive consumers back to cigarettes or lead to an increase in illicit products. The disposable e-cigarette market is a rapidly growing sector. Disposable e-cigarettes have proven popular not only with young users but also with those switching from cigarettes to new tobacco products.

These regulatory measures in Europe reflect authorities' desire to strike a balance between protecting consumer interests and restricting access to tobacco products.

Australia: Implementing a prescription model but facing challenges with the black market

Australia, which previously required a doctor's prescription for the purchase of e-cigarette products, has relaxed this restriction. Australian law stipulates that all e-cigarette products, whether containing nicotine or not, can only be sold through pharmacies. E-cigarettes with higher nicotine concentrations require a prescription. Tobacco retailers and convenience stores are prohibited from selling any type of e-cigarette products.

According to Australian regulations, starting October 1, 2024, adults aged 18 and over can purchase e-cigarettes with a nicotine concentration of 20 mg/ml in pharmacies. Before purchasing, consumers must consult a pharmacist for advice on product selection and dosage instructions. Consumers must also provide proof of age and are limited to a certain number of e-cigarettes per month.

Australian law limits e-cigarette flavors to mint, menthol, or tobacco and requires products to be packaged in plain packaging to reduce their appeal to consumers.

Despite Australia's efforts to prevent youth from accessing e-cigarettes through legal means, the country faces a significant challenge from the black market. It's estimated that approximately AUD 1.9 billion (AUD 1 = approximately RMB 4.68) worth of illegal tobacco products circulates annually in the country. Some industry stakeholders believe that Australia's regulatory approach not only restricts the development of the legal market, harms consumer interests, but also results in tax revenue losses.

North America: Flavor Restrictions and Marketing Challenges

Canada restricts e-cigarette flavors, allowing the sale of only tobacco, mint, and menthol flavored e-cigarettes. While these policies are intended to reduce the appeal of e-cigarettes to young people, they also affect adult e-cigarette users. Flavor variety is a key feature of e-cigarettes and a key factor in attracting consumers.

The U.S. Food and Drug Administration's proposed ban on the sale of menthol cigarettes in the United States has sparked a complex discussion. U.S. tobacco companies believe the ban would negatively impact legal sales, regulatory fairness, and the economic outlook. Since menthol cigarettes account for approximately one-third of U.S. cigarette sales, the proposed ban could significantly alter the market, with far-reaching implications for manufacturers and retailers.

US tobacco companies argue that removing menthol cigarettes from the legal market could inadvertently fuel the black market, potentially increasing smuggling and counterfeiting, posing challenges for law enforcement agencies and leading to tax losses for states that rely on tobacco excise taxes. Increased black market activity could complicate tobacco regulation and raise concerns about product safety and compliance.

There are also concerns that a menthol cigarette ban could strain relations between tobacco retailers and regulators. Retailers, particularly in regions with high demand for menthol cigarettes, argue that such restrictions could harm legitimate business and may not achieve the desired results. Furthermore, a menthol cigarette ban raises concerns about consumer autonomy, as menthol cigarettes have long been a popular choice for many adult smokers in the US market.

Asia: Economic Factors Influence Regulatory Decisions

In Asia, tobacco markets play a significant role in economic development in many countries, and regulatory decisions often consider the economic benefits of tobacco. Countries such as Japan and South Korea have embraced heated tobacco products, and their widespread adoption has led to a decrease in cigarette consumption.

Indonesia has implemented stricter tobacco regulations to address rising tobacco consumption and youth smoking, with a particular focus on e-cigarettes. Indonesia prohibits the sale of e-cigarettes to those under 21 and pregnant women, and has raised the minimum purchase age from 18 to 21. Furthermore, e-cigarette sales are restricted within 200 meters of schools or through online platforms without age verification. For traditional cigarettes, Indonesia prohibits the sale of single cigarettes and requires all cigarettes to be sold in packs of 20, aiming to prevent minors from accessing tobacco products and ensuring clear warnings on packaging.

Indonesia's e-cigarette restrictions include a maximum nicotine content limit in e-liquids and strict packaging standards, requiring 50% of e-cigarette packaging to contain warnings. The country also prohibits e-cigarette and cigarette advertising on social media and restricts physical advertising near schools and public places. Studies have shown an increase in e-cigarette use among Indonesian youth in recent years. The Indonesian government has taken proactive measures to address the high rates of tobacco use, particularly among young people.

India has a complete ban on e-cigarettes, but regulatory enforcement faces challenges due to the active illegal e-cigarette trade. India's situation illustrates the challenges of a complete ban on e-cigarettes, and suggests that scientific regulation and taxation may be more effective than a simple ban.

In June 2024, the Philippines introduced stricter regulations for e-cigarette products, marking a significant shift in the country's approach to controlling these products. According to the Department of Trade and Industry, all e-cigarette and heated tobacco products must undergo a certification process to obtain the Philippine Standard Mark and import clearance label, ensuring they meet quality and safety standards before being sold to consumers. To ensure a smooth transition, companies will have a six-month grace period to adjust their inventory, with full implementation of the certification process beginning in January 2025.

For tobacco companies, regulatory changes in various countries present both challenges and opportunities. Tobacco companies are adapting to the evolving market environment by diversifying their products and focusing on less restrictive sectors. The tobacco industry remains economically significant, and the successful implementation of relevant policies in both emerging and mature economies depends on striking a balance between consumer demand, economic development, and public health. Some stakeholders believe that a collaborative framework involving relevant companies and regulators should be established, focusing on consumer choice rather than simply adopting prohibitive measures.

Source: Oriental Tobacco News

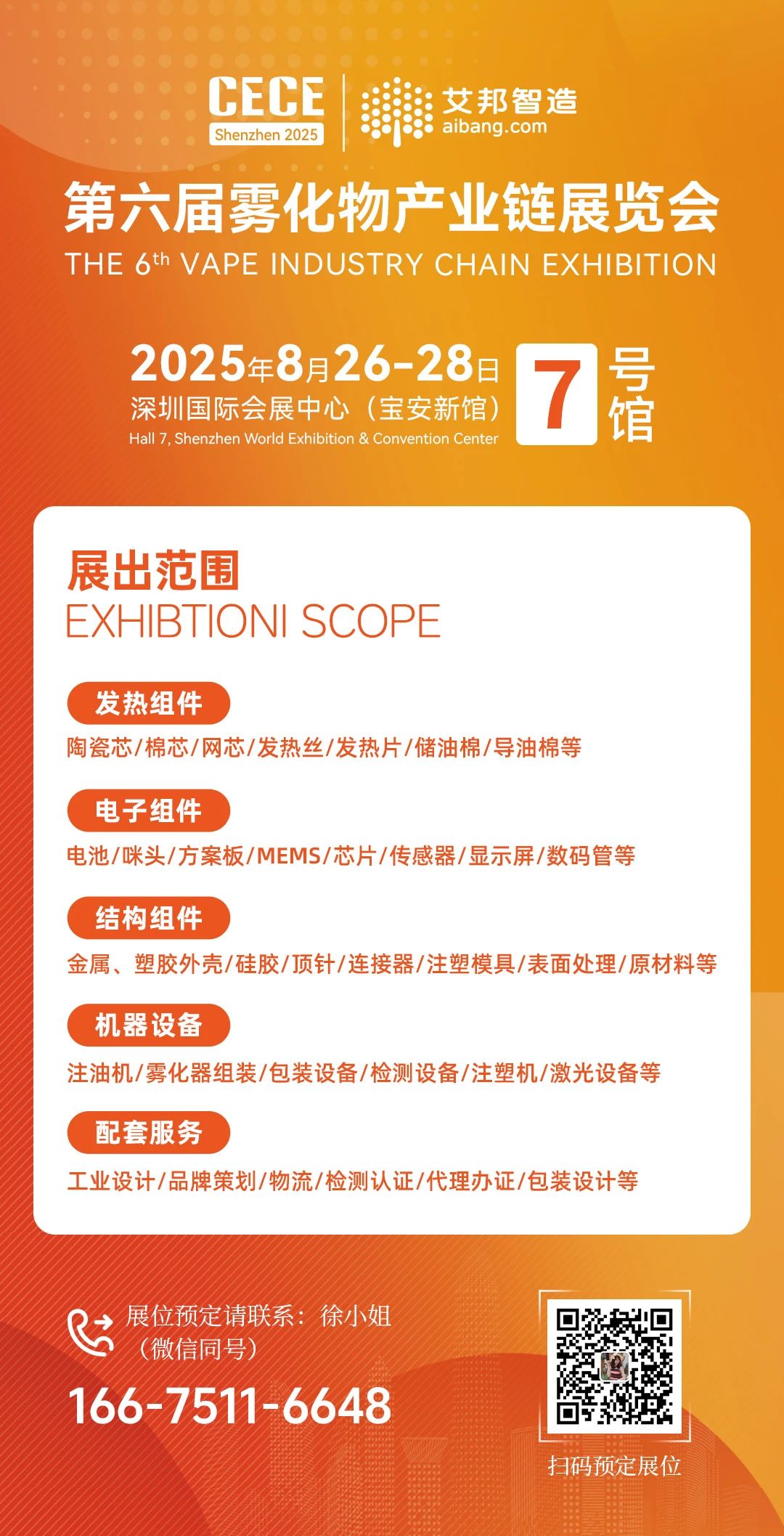

Recommended Events

电子雾化与HNB产品都是新型电子产品,结构虽小,却融合应用多种材料、表面处理、芯片电子等技术工艺,而且雾化技术一直在不断更迭,供应链在逐步完善,为了促进供应链企业间有一个良好的对接交流,艾邦搭建产业微信群交流平台,欢迎加入;Vape e-cigarettes (VAPE) and Heat-Not-Burn e-cigarettes (HNB) are both emerging electronic products. Despite their compact size, they integrate various materials, surface treatment technologies, chip electronics, and other advanced technical processes. Moreover, atomization technology is constantly evolving and the supply chain is being progressively perfected. To facilitate good communication and networking among supply chain enterprises, Aibang has established an industry WeChat group communication platform and warmly welcomes interested enterprises to join.