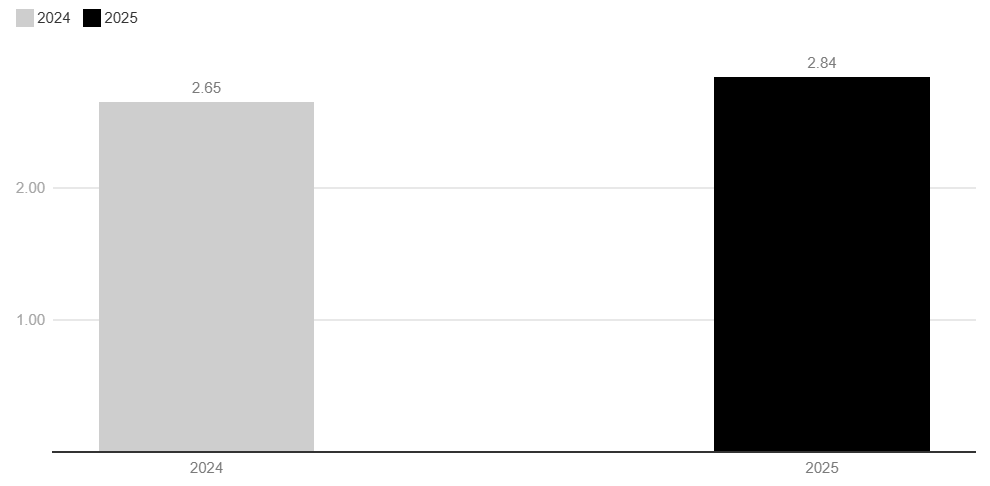

According to data released by the Indonesian Ministry of Finance and Customs, the country's e-cigarette consumption tax revenue reached 2.84 trillion Indonesian Rupiah (approximately US$170 million) in 2025, a year-on-year increase of 7.38% compared to 2.65 trillion Indonesian Rupiah (approximately US$159 million) in 2024, achieving growth against the trend of overall tobacco-related tax revenue decline.

In terms of revenue structure, open-system e-cigarettes contributed the largest share , with revenue reaching 1.32771 trillion Indonesian Rupiahs; followed by solid-state e-cigarettes (heated tobacco), with revenue of 1.21039 trillion Indonesian Rupiahs; and closed-system liquid e-cigarettes ranked third with revenue of 304.14 billion Indonesian Rupiahs.

It is worth noting that Indonesia's total consumption tax revenue in 2025 was 221.7 trillion Indonesian Rupiahs (approximately US$13.302 billion), a decrease of 2.1% year-on-year, achieving only 90.8% of the annual budget target. Among them, tobacco product consumption tax (CHT) revenue was 211.7 trillion Indonesian Rupiahs (approximately US$12.702 billion), lower than 216.9 trillion Indonesian Rupiahs (approximately US$13.014 billion) in 2024. The growth of e-cigarette consumption tax became an important highlight in the tobacco tax revenue sector.

Since January 1, 2024, Indonesia has officially included e-cigarettes in the tobacco product excise tax (CHT) and tobacco tax system. From January 1, 2025, according to Indonesian Ministry of Finance Regulation No. 96 (PMK 96/2024), the minimum retail price (HJE) of e-cigarettes has been increased, but the excise tax rate remains the same as in 2024. Specifically, the minimum retail price for solid e-cigarettes (heated tobacco) is 6240 Indonesian Rupiah/gram (an increase of 6.01%), open-system refillable e-cigarettes are 1368 Indonesian Rupiah/gram (an increase of 22.03%), and closed-system e-cigarettes are 41983 Indonesian Rupiah/gram (an increase of 22.03%).

In addition, the regulations also adjusted the minimum retail prices of other tobacco processed products, including tobacco molasses, snuff, and chewing tobacco, with prices increasing by 6.19% to 257 Indonesian Rupiah per gram, while the excise tax rate remained unchanged at 135 Indonesian Rupiah per gram.

电子雾化与HNB产品都是新型电子产品,结构虽小,却融合应用多种材料、表面处理、芯片电子等技术工艺,而且雾化技术一直在不断更迭,供应链在逐步完善,为了促进供应链企业间有一个良好的对接交流,艾邦搭建产业微信群交流平台,欢迎加入;Vape e-cigarettes (VAPE) and Heat-Not-Burn e-cigarettes (HNB) are both emerging electronic products. Despite their compact size, they integrate various materials, surface treatment technologies, chip electronics, and other advanced technical processes. Moreover, atomization technology is constantly evolving and the supply chain is being progressively perfected. To facilitate good communication and networking among supply chain enterprises, Aibang has established an industry WeChat group communication platform and warmly welcomes interested enterprises to join.