On October 30, 2025, JT Corporation released its financial results for the third quarter of 2025. The data showed that its core tobacco business performed particularly well, especially with sales of novel tobacco products (RRPs) surging by over 40% year-on-year, becoming a key driver of performance. Based on this strong quarterly performance, JT also raised its full-year earnings forecast.

I. Q3 Performance: Revenue and Profit Both Surge, Multiple Indicators Exceed Expectations

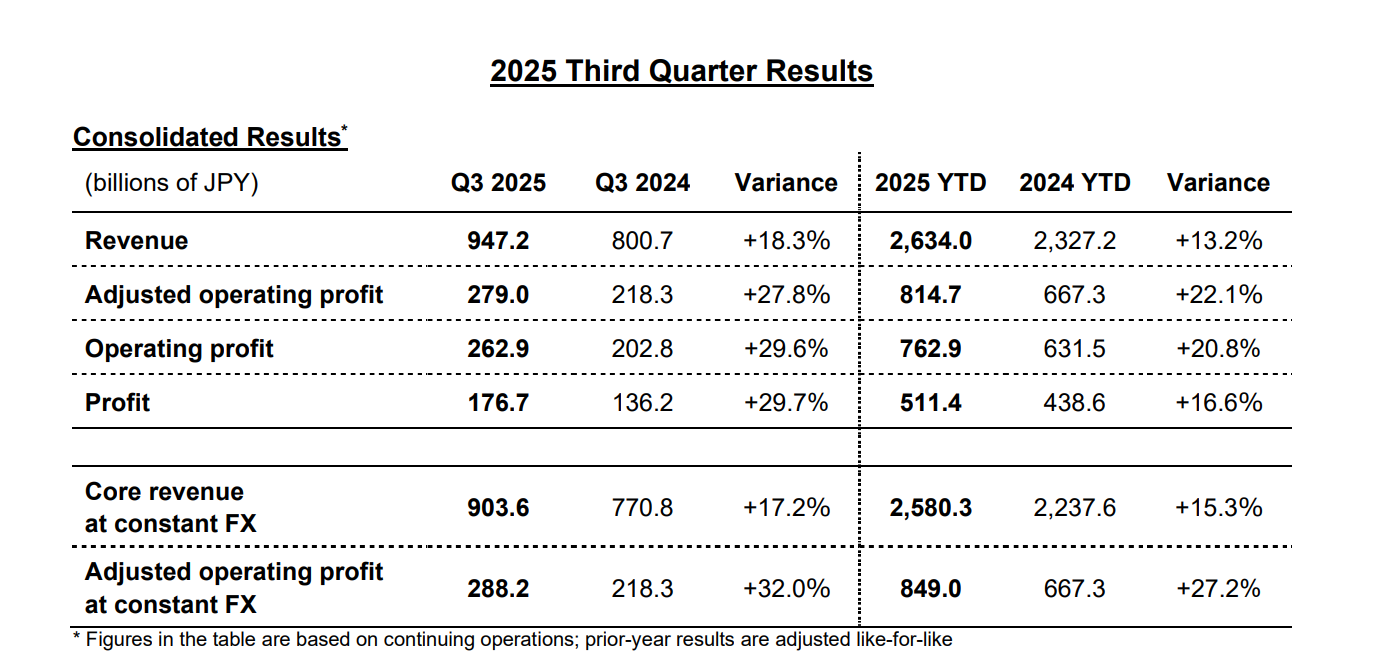

- Revenue: Reached 947.2 billion yen, up 18.3% year-on-year, with a significant acceleration in growth.

- Adjusted operating profit: reached 279 billion yen, an increase of 27.8% year-on-year.

- Net profit: reached 176.7 billion yen, an increase of 29.7% year-on-year.

II. Growth Drivers: Tobacco Business Driven by Two Engines, with New Types of Tobacco Products Becoming the Biggest Highlight

1. New tobacco products (RRP): Growth rate exceeds 40%, market share in Japan hits new high.

JT's strategic layout in the field of harm reduction products continues to yield results, with its new tobacco business experiencing both volume and price increases in Q3:

- Sales Explosion: Total RRP sales reached 3.8 billion units, a surge of 40.1% year-on-year, with heated tobacco products (HTS) performing particularly well, with sales increasing by 53.4% year-on-year, making it the fastest-growing sub-category;

- Accelerated market penetration: In the Japanese market, the launch of the new Ploom AURA and EVO premium e-cigarette cartridges directly boosted JT Group's market share in the HTS sector to 15.5%, and the number of Ploom series users nearly doubled compared to two years ago, with user loyalty and brand recognition significantly improved.

- Increased revenue contribution: RRP-related revenue reached 35.5 billion yen, a year-on-year increase of 42.6%, which not only far exceeded the growth rate of the overall business, but also became the core driving force for the revenue growth of the tobacco sector.

2. Traditional Cigarettes: Steady Growth, Continued Release of Merger and Acquisition Benefits

Despite the industry's shift towards new tobacco products, JT Group's traditional cigarette business continues to demonstrate strong resilience:

- Sales steadily increased: Q3 sales of traditional cigarettes reached 151.5 billion sticks, a year-on-year increase of 4.2%, mainly due to the continued contribution of Vector Group, which was acquired last year, as well as the increase in market share in Turkey, Russia and other markets;

- Strong performance of flagship brands: Global flagship brands (Winston, Camel, MEVIUS, LD) performed exceptionally well, with Winston's sales increasing by 7.8% year-on-year and Camel's by 5.6%, further consolidating their brand power;

- Regional growth diverged: Europe, the Middle East and Africa (EMA) cluster became the traditional main driver of cigarette sales growth, with sales increasing by 8.3% year-on-year, while the Asia and Western Europe clusters were affected by industry volume fluctuations, resulting in relatively slower growth, but their market share remained stable.

III. Full-year earnings forecast significantly revised upward: multiple indicators hit record highs

- Revenue and Profit: Full-year revenue is projected to reach ¥3.456 trillion (up 13.1% year-on-year), with adjusted operating profit of ¥903 billion (up 21.6% year-on-year). If calculated at constant exchange rates, the adjusted operating profit growth rate is even higher at 24.3%.

- With a clear strategic direction, JT Group President Masamichi Terabatake stated that the strong third-quarter results were driven by continued growth in the tobacco business, particularly the global expansion of the Ploom series and the successful integration of Vector Group. Moving forward, the Group will continue to adhere to the "4S Management Principles" (meeting the needs of consumers, shareholders, employees, and society), closely monitor changes in the external environment, further advance the global deployment of harm-reduction products, and ensure the achievement of its 2025 performance targets.

电子雾化与HNB产品都是新型电子产品,结构虽小,却融合应用多种材料、表面处理、芯片电子等技术工艺,而且雾化技术一直在不断更迭,供应链在逐步完善,为了促进供应链企业间有一个良好的对接交流,艾邦搭建产业微信群交流平台,欢迎加入;Vape e-cigarettes (VAPE) and Heat-Not-Burn e-cigarettes (HNB) are both emerging electronic products. Despite their compact size, they integrate various materials, surface treatment technologies, chip electronics, and other advanced technical processes. Moreover, atomization technology is constantly evolving and the supply chain is being progressively perfected. To facilitate good communication and networking among supply chain enterprises, Aibang has established an industry WeChat group communication platform and warmly welcomes interested enterprises to join.